Origins and delusions of green growth

It is difficult not to admire the conjurors who dreamt up “green growth” and the “green economy,” the latest brand labels of eco-concerned capitalism. These projects appear immune to critique. For an economy is essential to the production and reproduction of social existence; and what can an economy usefully do but grow—in emulation of its chlorophyll-coated friends that adorn the countryside?

Green growth and green economy represent a new phase in the reconstruction of political discourse in the face of ecological challenges and environmental movements. The discourse out of which the terms evolved goes back to the 1960s and 1970s. Those decades saw environmentalism go mainstream, as soaring oil prices fuelled a concern with natural “limits to growth,” as evinced in the advent of “ecological economics” and a plethora of moral critiques of industrial civilization, such as A Blueprint for Survival. In 1972 the United Nations proclaimed its Stockholm Declaration on the environment. Two years later, the World Council of Churches conference in Bucharest coined the phrase “ecologically sustainable society.” There followed, in quick succession, a series of reports by state-sponsored think tanks (notably the Hammarskjöld Foundation and the Brandt Commission) that warned against the conflation of growth and development. “Sustainable development” was the buzzword of the time. It connoted grassroots engagement, equality and social justice, local empowerment, and low-impact development. Slowly but surely, however, its radical threads were appropriated by sustainable development’s official sponsors: the UN, plus an array of NGOs and think tanks. By 1987 the official hour of sustainable development had arrived: the UN-backed Brundtland Commission defined it as “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.”1 Five years later, at the Rio Earth Summit, it assumed a starring role as gospel and mantra of the mainstream environmental movement.

Despite (or because of) the social democratic aspirations embodied in sustainable development, it was always under suspicion of applying a green gloss to capitalist expansion in the Global South. Its critics, such as Sharachchandra Lélé, dismissed it as “a fashionable phrase that everyone pays homage to but nobody can define.”2 Some wondered whether the “new paradigm” it promised was “simply a greenwash over business-as-usual.”3 Others perceived in it a hegemonic “cover-up operation” designed to reassure a public anxious over the consequences of economic growth that these could be ameliorated without the need for any “radical challenge” to the prevailing economic system.4 Little by little, ecological meanings were usurped, such that by the 2000s sustainable development had “become virtually synonymous with sustained economic growth.”5 In December 2014 a farcical nadir was reached when Danish policymakers rationalized their latest Arctic land-and-sea grab in terms of their ability to ensure the region’s fossil-fuel reserves will be “developed sustainably.”6

As sustainable development—the discourse and project—lost its way, it gradually, inexorably, found itself folded into a new framework: green economy and green growth. At first sight these could appear simply as a reprise of sustainable development. However, their emergence was significant in that they steered the existing debate in a particular direction. In the green economy discourse, three aspects stand out in comparison to its sustainable development predecessor. First, it stands for new methods of intervention in the environment, with nature reframed, in the words of Anneleen Kenis and Matthias Lievens, as “a specific type of capital, which needs to be measured, conserved, produced, and even accumulated.”7 Nature comes to stand for a collection of tradable ecosystem services, which, as Larry Lohmann explains, are “mobilized to defend productivity gains, minimize costs of capital expansion, and stave off crises of reproduction.” Just as in earlier eras the commodity labor power was “unbundled from the human activity of commoners (or slaves) and made ownable and transferable,” so, in the dawning era of the green economy, “carbon-cycling capacity and other ecosystem services are to be unbundled from the activities of the earth and made circulatable and accumulable.”8 Secondly, green economism insists much more assertively that environmental sustainability is reliant upon the market system. Hope for the world lies with an eco-industrial revolution sparked by technological innovation and directed by market signals. “Going green” is an economic opportunity; its heroes are “sustainable entrepreneurs,” banks and corporations. Thirdly and relatedly, it unconditionally embraces green growth. Where “sustainable” rings rather grey and technical, “green” is vivid; and where “development” is restricted to the Global South and can seem abstract and subjective, “growth” is global in scope and sounds solid. Green growth directly taps the accumulated symbolic capital of environmental movements, and being measurable in dollars, it resonates with an environmental discourse that has become increasingly “economized” in the neoliberal age. Perhaps the most resounding appeal of growth is that in previous centuries it provided the vital ingredient with which to solder critical social movements to capitalism: social democracy, communism, and then environmentalism.

What had changed? What had opened the door to growth? One factor was that many states and businesses, together with the major international organizations, felt a need to embrace (and especially to appear to embrace) environmental causes. This was most evident in respect to climate change, on the perils of which the scientific consensus was solidifying. In corporate boardrooms the recognition dawned that climate change-related regulation would come, inexorably.9 A survey of 350 of the world’s biggest firms revealed that “climate change and the various regulatory, policy, and business responses to it” were driving “a worldwide economic and industrial restructuring” that was set to redefine “the very basis of competitive advantage and financial performance” for companies and their investors.10 Eager to be in a position to influence the new era, corporations grew more active in lobbying governments on environmental regulation.11 Corporate partnerships with NGOs blossomed too; a clarion example was the World Wildlife Fund’s pantheon of sponsors and funders: Nokia, HP, Volvo, Ikea, Sony, and even Monsanto.12

A second spur to the green growth discourse arrived with the world economic crisis of 2008. Blue-chip behemoths such as AIG collapsed, while others staggered under mountainous losses—a gargantuan debt burden that was quickly and slickly transferred to taxpayers. In the North, economic growth collapsed, and remained sluggish even after the initial crisis subsided. Social polarization accelerated, and established parliamentary parties faced sullen or angry electorates. Amidst the tumult, the neoliberal policy regime faced a legitimacy crisis, to which, broadly speaking, three responses were possible.13 One was to urge it to march on as if nothing had happened. (Some refer to this as “zombie neoliberalism.”14) A second was to call for self-reinvention—and it is in this connection that a good deal of the green economy discourse should be understood. A third was to propose its demise and replacement. Here too, environmental issues played a prominent part, as witnessed in the reports by Britain’s Green New Deal Group, with their demands for Keynesian crisis resolution centered on environmentally oriented fiscal stimuli.

Green growth: a concrete example

According to the UN, green growth emerged as a strategic project in 2005: specifically, at the Fifth Ministerial Conference on Environment and Development, at which “Fifty-two Governments and other stakeholders from Asia and the Pacific agreed to move beyond the sustainable development rhetoric and pursue a path of ‘green growth.’”15 The conference venue was Seoul, and this was no coincidence. South Korea has been instrumental in promoting the concept, through the Organization for Economic Cooperation and Development (OECD), Association of Southeast Nations, and the UN. In 2008, Korea’s Lee administration adopted green growth as its “new development vision,” and a year later the National Strategy for Green Growth and Five-Year Plan for Green Growth were announced.

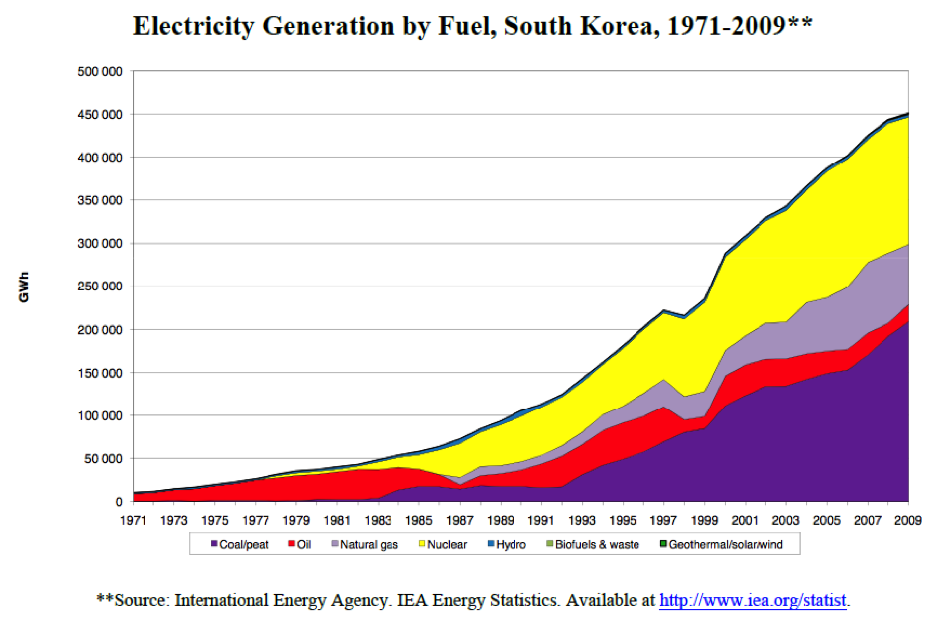

At face value, South Korea appeared in dire need of green growth. An environmental disaster zone, its manufacturing output had increased by a jaw-dropping twenty percent per year throughout the 1960s and 1970s, and in subsequent decades its energy consumption soared even more rapidly, as Figure 1 shows. Its greenhouse gas emissions doubled from 1990 to 2005, the steepest rise of all OECD countries. By 2008 its consumption of energy, pesticides, and fertilizer, as well as its carbon-dioxide emissions, were “among the highest in the world relative to the size of the nation’s economy,”16 and it had become the world’s second largest importer of coal, to supply its skyrocketing electricity demand (the dark blue wedge in Figure 1).

Figure 1

A striking aspect of South Korea’s green growth program was that it was expedited as a defining policy initiative not under President Roh Moo-Hyun, a former human rights lawyer and social movement activist, but under Lee Myung-bak. Lee was an unlikely eco-warrior. A former CEO of Hyundai construction, his nickname was “Bulldozer.” But he converted to the environmental cause—at least according to Time magazine, which anointed him its 2007 “Hero of the Environment.” According to Time, during his spell as mayor of Seoul, “The Bulldozer went green—and in dramatic fashion.” He let it be known

that he would tear out the jam-packed elevated highway that ran through the heart of Seoul and restore the buried Cheonggyecheon stream—a foul urban waterway that Lee himself had helped pave over in the 1960s. His opponents insisted that the plan would cause traffic chaos and cost billions, but the voters elected Lee. Three years later, Cheonggyecheon was reborn, an environmentally friendly civic jewel that has changed the face of Seoul. More quietly, Lee also revamped the city’s transportation system, adding clean rapid-transit buses. But his lasting accomplishment was in changing the Asian political dynamic, showing that environmentalism can go hand in hand with development.17

Oddly perhaps, Lee said nothing about greening South Korea during his campaign for the presidency. Yet upon his inauguration in 2008, he abruptly hit upon green growth as the nation’s economic development philosophy.

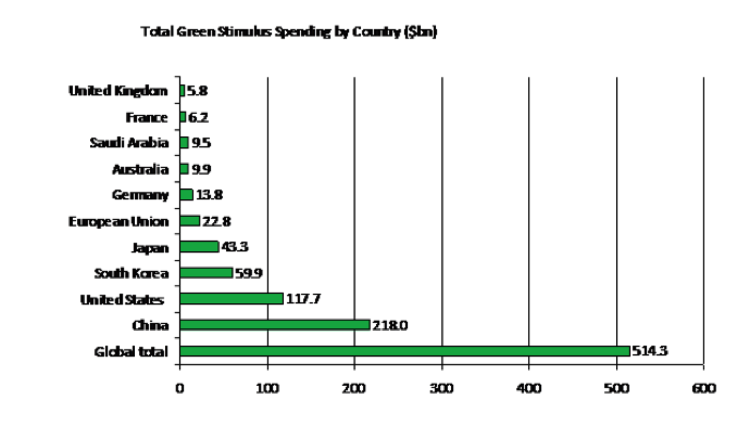

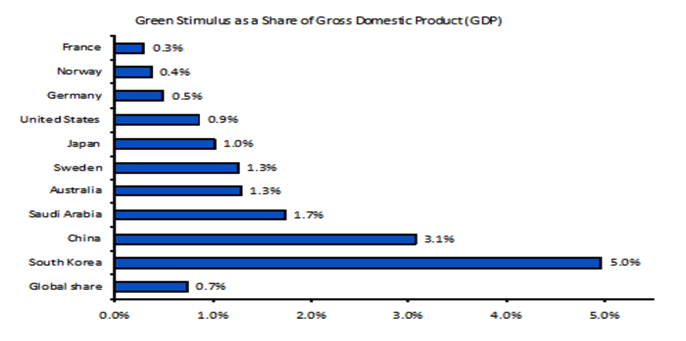

The year of Lee’s inauguration, 2008, also saw the onset of global economic crisis. A number of governments launched fiscal stimulus programs, and a green element was prominent in several. In the league of green stimuli, South Korea came third in absolute terms and led the field in per capita terms, as illustrated in Figures 2 and 3.18

Figure 2

“Green” Stimulus Spending ($bn), September 2008 -- December 2009

Source: Edward Barbier, www.japanfocus.org/-Edward_B_-Barbier/3383.

Figure 3

“Green” Stimulus as a share of GDP, September 2008 -- December 2009

Source: Edward Barbier, www.japanfocus.org/-Edward_B_-Barbier/3383.

Lee Myung-bak’s Green New Deal underwrote South Korea’s bid for global leadership in the field of green growth. In 2008, it set up the East Asia Climate Partnership, a $200 million initiative designed to bring Korea’s “know-how and resources to foster green growth, adaptation and improved resource management to developing countries.”19 In 2009, Korea was lauded by the United Nations Environment Program (UNEP) as “a model green-growth nation,” with particular commendation for the size of its “stimulus package” and the efficiency with which it was disbursed.20 In 2010, Lee was awarded the Zayed International Prize for the Environment, the most prestigious international environmental award, for his “vision and leadership” in pursuing green growth and in transforming his country “into a low carbon, resource efficient, and Green Economy.”21 The same year saw Korea establish the Global Green Growth Institute (GGGI), which was later given the UN blessing as a new international organization at the Rio+20 Conference. The GGGI is dedicated, in general, to promoting the credo that economic growth and environmental sustainability are codependent, and, specifically, to championing green growth as a new model of development geared to enabling Asia-Pacific countries to “‘leapfrog’ over the industrialization patterns of the developed world,” dodging the old brown trap of “growing first, cleaning up later.”22 When the new organization attracted several donor countries, including Britain, Australia, and Qatar, observers pointed out that the GGGI was not only the first Korea-born international organization; it also signalled that other states were “willing to accept (and fund) South Korea’s leadership in matters of international concern.”23

Just a year after the establishment of the GGGI, the OECD brought out its “Towards Green Growth” manifesto, which billed South Korea as the first of four green growth case studies, and featured its flagship green city, New Songdo, on the inside cover.

Scheduled for completion in 2018, the ground for New Songdo City was broken in 2004 and it soon began to assert itself as a green hub, frequently playing host to international environmental events, with the breakthrough moment being its selection to host the UN’s Green Climate Fund, a major component within the United Nations Framework Convention on Climate Change. The many environmental delegates who entered Songdo’s portals were able to gasp at its carbon-saving wizardry. In his five-star Sheraton Hotel room, one US delegate to the 2009 Global Environment Forum gushed, not only did his “room entry card activate and de-activate all lights and appliances” when he entered or left, “it also turned on or shut off the room’s cooling system”; and when he jogged through New Songdo’s “car-free” (!) Central Park, he found himself “taken by how established its many plant, grass and tree species were, despite construction still in progress.” New Songdo, it would have been churlish to deny, had fully earned its spearhead role in the global fight against climate change.24

Many suspected that, beneath the bombast, South Korea’s green growth initiatives did possess certified ecological credentials. But if so, what were they? Let us look more closely, by retelling the story from 2007. In that year, Lee, in preparation for his presidential bid, proposed the construction of a Pan-Korea Grand Waterway, acclaimed as “one of the most grandiose public works schemes in decades.”25 The plan was to carve out a colossal canal system, centered on a 336-mile super-canal that would enable cargo freighters to steam through flooded mountain tunnels from Seoul across to Busan. All four of South Korea’s major rivers were to be “heavily dredged, channelized, and fitted with locks and dams.”26 Seventeen smaller canals were added to the plan. In all, 1,926 miles of rivers were to be re-engineered as slow-water canals. At this stage the plan was typically South Korean: pave the river banks to keep the concrete mixers churning; slow down the waters to keep trade and finance flowing.

Lee’s plan, however, encountered a tumult of opposition. It would be “an environmental catastrophe and a massive boondoggle,” said its detractors.27 Shortly afterward, his popularity slumped dramatically, and although this was due chiefly to a separate issue (his backing for the importation of US beef), in order to shore up support he vowed to drop the Grand Waterway. A contrite president addressed the press, saying, “I made a pledge to construct the Pan-Korea Grand Waterway. However, if the people object to it, I will not push it.”28 Some thought democracy the winner, but, ominously, the stocks of the major construction companies tumbled.

It was at this precise moment that Lee experienced his ecological epiphany and the Green New Deal was born. It was a stroke of genius. The Green New Deal would create an estimated 960,000 new jobs, and would include a number of eye-catching, and undeniably green, measures, including investment in renewable energies and a tree-planting program. The headlines were “green” and “jobs,” and few voters would study the small print.

Those who did examine the plan in detail were underwhelmed. For all the rhetoric about renewables, these were predicted to rise from 2.7 percent of overall energy consumption in 2009 to a still-piffling 6.1 percent in 2020.29 Most of the envisaged nonhydrocarbon energy expansion, and the largest share of the budget for green technology development (36 percent in 2009),30 was earmarked for nuclear power, even though South Korea at the time already boasted “the highest density of nuclear power reactors in the world, and the fifth highest installed capacity.”31 From twenty-three reactors, the number was set to rise to forty-one. Additionally, there would be investment in hybrid vehicles, and in Kia’s hydrogen-powered SUV, the Mohave (a.k.a., Borrego).32 Given that hybrids run on a mix of hydrocarbons and electricity, and the Mohave on electricity alone, their fuel is the same color as their electricity supply—which in Korea, as elsewhere, will for the foreseeable future be a brown shade of black, with a radioactive tinge. But by far the largest project, accounting for 37 percent of the Green New Deal budget, was a scheme entitled the Four Rivers Restoration Project. Its measures included the construction of twenty-one dams, the rebuilding of ninety-six old dams, the reinforcement of several hundred miles of riverbanks with concrete and the dredging of 570 million cubic meters of sediment to deepen over 400 miles of riverbed.33 The project, the government insisted, was about river restoration and flood prevention and had nothing to do with the abandoned Grand Waterway plan. But critics pointed out that the four rivers earmarked for restoration were the same as those at the core of the Grand Waterway scheme.34 One member of the team behind the Four Rivers project claimed that it was nothing but the Grand Waterway scheme “in disguise.” He was suspended from his job for three months.35 It was a sign of things to come. Korea’s green growth strategy coincided with a process of ruthlessly excluding traditional green perspectives, and representation in environmental policymaking was vigilantly restricted to include only advocates of market-driven green growth.36

When the layers of rhetoric were peeled from President Lee’s Green New Deal, its core was revealed to be nuclear energy expansion, land reclamation, canal cutting and dredging, and the construction of a multitude of dams and weirs—all of which would place further stress on the country’s embattled wildlife.37 Far from the “Bulldozer” experiencing a Damascene conversion, his Green New Deal was corporate South Korea through and through, fronted by mammoth civil engineering projects.

Simultaneously, a similar contradiction between environmental protection and green growth was witnessed at the New Songdo site. As the Smart City arose from the marshland it faced a barrage of criticism from environmentalists. They accused its authors of having been motivated primarily by a desire to cash in on South Korea’s property bubble, and the environmental harm, they said, caused by building an entirely new city from scratch far outweighed that occasioned by upgrading existing urban areas. Specifically, its construction required the draining of the Songdo Tidal Flat, a vital way station for migratory birds.38 The equation was simple: flying creatures were to make way for flying machines. On its website, on the left side bar immediately beneath the sustainability section, the eye is drawn to the button labelled “aerotropolis”:

An aerotropolis is a metropolis built around an airport, and New Songdo City is unabashedly that. According to its publicity materials, it is “a compelling aerotropolis strategically located just over seven miles from Incheon International Airport.” In plain English, it is a city designed to encourage the expansion of the aviation industry, a mechanism for the injection of incalculable quantities of carbon dioxide and other chemicals directly into the upper troposphere.

How far has the signifier “green” floated since it was first coined; far indeed from its earlier connotations of grassroots democracy, peace and nonviolence, feminism, not to mention resistance to nuclear energy and scepticism toward the growth imperative.39 Under South Korean leadership, green growth has risen to prominence. Green has been harnessed to a frenzy of nuclear power plant construction40 and the industrial-scale reengineering of the environment—one that was steered by bureaucratic institutions that are brazenly top-down in their processes of decision-making and environmental impact assessment. And for what ecological benefit? South Korea’s energy consumption and greenhouse gas emissions increased in the six years following the inauguration of the Green New Deal. Far from a decoupling of emissions and growth, the GDP growth rate was lower than that of energy consumption.41 In 2010, South Korea’s greenhouse gas emissions soared by 10 percent, twice the global average, and in the same year its ranking in the worldwide Environmental Performance Index plummeted by forty-three places (as compared to 2008), to ninety-fourth position among 163 countries, the lowest in the OECD.42

What, then, lay behind South Korea’s green growth strategy? At the level of rhetoric, it affected to offer psychological compensation to citizens’ grievances over the severe environmental degradation that had accumulated across decades of breakneck industrialization. But its real driving forces were geopolitical and political-economic. The political class tended to foreground the former. The South Korean government, in this narrative, was constructing green growth as a global issue, with Lee assuming a global leadership role. “If we make up our minds before others and take action,” he pronounced in 2008, “we will be able to lead green growth and take the initiative in a new civilization,” and Korea would experience a renaissance “as a green power.”43 A year later, Prime Minister Han Seung‐soo proposed that “low carbon, green growth must be a paradigm not only for Korea but for the international community as a whole,” adding that his country was ready “to lead this process.”44 More central still, however, were political-economic considerations. Lee’s Green New Deal has often been described as Keynesian, and not without reason, for it was an exercise in state-funded construction and land redevelopment programs, launched during an economic downturn.45 However, one should not overlook its developmentalist (or Schumpeterian) aspect. Ever since the Park Chung-hee dictatorship (1961–79), South Korea has been a poster child of the state-guided industrialization model, exhibiting a resolute focus upon accelerating growth and enhancing the global competitiveness of South Korean business. Success in this strategy has required periodic shifts up the value chain, initiatives that, typically, have been driven by the state: from light to heavy manufacturing (chemicals, steel, and shipbuilding); from televisions and semiconductors to computers; from simple assembly to design and production.46 The search for new lines to enter, for new ways to rise up the value-added chain, is in the DNA of the South Korean regime, and the green growth initiative is little but a reprise of that recipe. Seoul’s five-year-planners perceived that a shift toward a lower-carbon economy, however slowly and belatedly, is likely to occur, and that leadership in the global race is up for grabs. With its manufacturing, engineering, and research base, supportive government policies and a domestic market of sufficient scale to give its manufacturers a solid base, South Korea was well positioned to capitalize.47 For example, the massive green investment in the nuclear industry could assist businesses in breaking into external markets—as witnessed for example in the export of four nuclear power plants to the United Arab Emirates. If successful, the strategy would help to confirm the renaissance, in neoliberal form, of South Korea’s developmental state, following its travails in the wake of the 1998 “Asian crisis.”48

Green growth: the radical version

I have devoted some attention to South Korea because it is a—even “the”—paragon of green growth. In South Korea we have been able to observe, as if in laboratory conditions, what transpires when green is mixed with growth: the manufacture of greenwash on an industrial scale. Also of relevance is the approval that Lee’s green growth plan received among Green parties and movements around the world. Greenwash detectors were everywhere laid aside. In Britain, for example, a green-connected think tank, the New Economics Foundation (NEF), endorsed it, as did the Green Party itself.49 “What a pity,” the latter announced on its website, that “Britain isn’t more like South Korea, which is spending 82 percent of its stimulus package on green technology—which just shows that it can be done, given the political will.”50

Leading cadre of the NEF and the Green Party were involved in preparation of one of the more radical proposed solutions to environmental and economic crisis: the Green New Deal (GND) report of 2009. The GND Report offered a scathing critique of the neoliberal order and a muscular call for social-democratic change. It included an impressive list of alternative policies that, if implemented, would amount to a historic shift in policy priorities and power structures domestically and at the global level. Its policy proposals, however, were constructed upon a less satisfactory thesis: that the roots of “the triple crunch of financial meltdown, climate change, and ‘peak oil’” lay simply in the neoliberal model of “globalization.”51 This case was presented by way of a very particular rendition of twentieth century political-economic history. In essence, it is the tale of two wise men who paved the road toward a golden age, an age that was later undone by some frightful villainy. One of the two heroes was Franklin D. Roosevelt. In the early 1930s, he grew “bitter and furious with the greedy and feckless financial sector”—the major culprit in causing the Great Depression—and launched a “courageous program” that centered on its strict regulation. The other was John Maynard Keynes. He was “the instigator and genius” behind a radical and global “reordering of society.” His policies, notably the construction of “a soundly managed monetary system,” permitted “recovery from the Great Depression, underpinned the allied war effort and fostered the golden age of economic activity that prevailed until the 1970s.” This era of golden growth was inspired in part by government activity, but that was only one side of the story. Impressive levels of output, growth, and prosperity “were also the result of private activity.” The mixed economy, its financial sector regulated along Keynesian lines, yielded “stability and growth,” with “industry thriving and investing heartily.” But then, in the 1970s, the golden threads unravelled. “Financiers began increasingly to organize themselves to persuade governments to loosen their control.”52 The dark age ensued.

As Tadzio Mueller has pointed out, the GND rendition of twentieth-century history is unsound. It misrepresents the “old” New Deal as “a technocratic gentlemen’s agreement” between Keynes and Roosevelt, when its most progressive features were in fact fought for by labor and other social movements. Moreover, it holds not capitalism but neoliberal globalization to blame for the ecological crisis, a narrative that conveniently elides the environmental destruction wrought in the decades between Roosevelt and Reagan.53 This framing of events is symptomatic. First, Mueller argues, the GND’s focus on the harms that accumulated under neoliberal globalization obscures the antagonism between the growth imperative and environmental needs and constraints. This opens the road to a resumption of capitalist growth under Keynesian auspices. Second, its neglect of social struggles licenses illusions in a harmonious capitalism capable of blending the interests of capital (in profit), the state (in legitimacy), labor (in decent, green jobs), and the environment.54 In reality, the New Deal and Keynesian embedded liberalism stabilized class conflict within an order characterized by inexorably expanding commodification and commercialism, militarism, and an oil grab in the Middle East (launched by Roosevelt himself), and of course accelerated environmental deterioration. The golden age was also a carbon age, in which emissions increased more rapidly than during any other era.55 For all the reforms of Roosevelt and Keynesian social democracy, the major means of production, worldwide, remained in the hands of existing business elites whose primary goal remained the accumulation of capital. They were able to use their wealth and power to evade regulations that restricted them in that end, lobbying politicians and influencing public opinion. The preconditions for the neoliberal turn were, in the Keynesian era, vitally present in the shape of entrenched capitalist classes, assisted by the mixed-economy instincts of social democracy. Private capital, having been somewhat inconvenienced by political regulation during the long boom, saw the crisis of the 1970s and the failure of Keynesian policies to restore profit rates as an opportunity for revanche. Against this background, a number of elements in the GND Report cause eyebrows to be raised: its support for carbon markets, for example, and the insistence that its policies favor “a much bigger role for investments from private savings, pensions, banks and insurance” than did Roosevelt’s New Deal.56

In response to those who have criticized green growth, of which the GND Report is the most radical (if sotto voce) advocate, one of its authors, the Guardian’s economics editor Larry Elliott, has issued a challenge.

Green growth is anathema to some in the environmental movement, who see it as an oxymoron. But the alternative is to tell people living in New Jersey, New South Wales, and West Sussex that they are going to see their living standards fall but that they should not worry because they will be no less happy as a result. Best of luck with that.57

At first blush this is a powerful argument: realistic and tough minded. And to the list of provinces one could of course add Attica, Bahia, and Chennai. How, then, might those who see green growth “as an oxymoron” respond?

Capitalism and growth

The response can be framed in several different registers. One is in a sense the logical baseline: human society is in and of the natural world. The habitability of the planet (the environment) is the indispensable precondition for the subsistence and well-being of homo sapiens—and for that matter of all living species. Through habitat destruction, ocean acidification, and climate change, the danger looms of an anthropogenic sixth great extinction, one that could even conceivably wipe out the good citizens of New Jersey, New South Wales, and West Sussex. Here is not the place to analyze the relationship between growth and environmental crisis. But consider just one aspect of the relationship: the increase in greenhouse gas emissions, with their well-documented consequences for ocean acidification and climate change. Green growth advocates suppose that growth and emissions reductions can go hand in hand with a decoupling of growth from resource throughput. But for meaningful progress to be achieved on this front, the decoupling would have to occur quickly, globally, and permanently. Crucially, it would have to be absolute (with an absolute reduction in emissions) rather than relative (a decline in the ratio of emissions to GDP).58 How feasible is this program? According to Ulrich Hoffmann of the United Nations Conference on Trade and Development, the limitation of global warming to the comparatively safe figure of 2˚C would require a reduction in the global carbon intensity of production to an amount equivalent to a twenty-one-fold improvement on the current global average.59 If this were attempted while allowing countries of the Global South to achieve a level of per capita GDP comparable with the EU average, a much greater reduction would be required—of nearly 130 times over the next thirty-five years.60 To put this in perspective, consider the actual historical instances in which emissions reductions have occurred. Apart from a brief window in post-unification Germany, Russia is the only sizeable economy that has seen a substantial emissions reduction in recent times. Its carbon emissions fell by almost 3 percent annually in 1990–2005, and that was thanks to industrial collapse. The world would have to repeat that experience, and without Russia’s fallback on hydrocarbons (and the credit lines based on them), for decades on end and at roughly three times the rate to even achieve medium-term limitation of global warming to the very-far-from-safe figure of 3˚C.61 To believe that emissions reductions on the scale required is compatible with a growth-oriented world economy is utopian folly.

But what is a growth-oriented economy? Here we come to the second register: the relationship between economic growth and the prevailing mode of production. In precapitalist civilizations commitments to certain forms of growth were present. Monarchs and aristocrats sought to enhance their territorial acquisitions and riches, and the motive for financial gain made itself powerfully felt in commercial trade and in usury. Certain precapitalist societies featured corporate institutions that sought to amass wealth, and scholarship in economic administration could achieve a high level of sophistication in determining the rules for good husbandry, management, and government. But there existed little or no sense of an economy as a separate sphere of social life, still less one that could be measured such that its growth could be assessed. Nor was there a systemic compulsion to growth. Whereas economic growth, in terms of an effective increase in per-capita production, has since the eighteenth century been sustained and rapid, before then it was at most punctuated and modest.62

The explanation lies in relations of production. Precapitalist ruling classes appropriated labor or rent directly, legitimated by reference to a divinely ordained social hierarchy. For the most part, trade existed in the interstices of the system; it was based upon monopolies in the supply of a limited range of goods and was dependent on political indulgence. Markets were geared around price disparities between separate spheres, and producers were directly attached to the means of subsistence and production.63 Those who depended for their livelihoods upon incomes generated through buying and selling on markets were greatly outnumbered by peasants whose access to a plot of land, or communal rights thereto, insulated them from market dependence. Because their subsistence was not market reliant they were under scant compulsion to conform to market norms; they could take their surplus produce to offload on local markets, but this is a different matter to producing for markets: they were likely to accept virtually any price for their wares, there being no advantage in keeping the surplus at home. If the incentive to produce above consumption needs was weak, the prospect of the requisition by taxation of additional product added a disincentive. The result was that, on the whole, only a slender surplus was available for purposes of investment or exchange. This was typically held by temple, church, or palace officials, and lords and kings; and of what they invested, relatively little was directed to productive assets, such as irrigation systems or windmills, as opposed to unproductive assets, such as ziggurats or castles.

Because the direct producers in precapitalist agrarian societies held direct access to their means of subsistence, the members of the class of exploiters, where one existed, were obliged, as Robert Brenner has argued, to reproduce their power and wealth through appropriating part of the product of the direct producers.64 Precapitalist property relations, in allowing both exploiters and producers direct access to their means of reproduction, “freed both exploiters and producers from the necessity to buy on the market what they needed to reproduce, thus of the necessity to produce for exchange, thus of the necessity to sell their output competitively on the market, and thus of the necessity to produce at the socially necessary rate.”65 In consequence, neither group experiences a persistent imperative to cut costs and the systemwide pressure “constantly to improve production through specialization and/or accumulation and/or innovation” remained slight or nonexistent.66

How does this connect to the question of growth? In the abstract, capitalism does not require growth in resource throughput but growth of surplus value (capital accumulation). Yet if accumulation is of an abstraction (exchange value), it has real-world effects. The survival and success of capitals depends upon increasing productivity and the size of their market, and productivity growth tends to require increases in the appropriability and usage of what Jason Moore calls the “Four Cheaps” (labor power, food, energy, and raw materials).67 The accumulation imperative is underscored by the modern form of ownership (corporations are owned by masses of shareholders who seek to maximize portfolio gains68), and by relations of credit (in expanding production, debts are incurred the repayment of which depends upon further expansion). A central role, moreover, is played by capitalism’s core institution, the labor market. This is in two respects. One concerns consumption. Within a system based upon the commodification of labor power, consumption is understood as the incentive to work and as compensation for what we lose through the alienation of our labor. (As such, as Sam Gindin observes, it fosters “an individualized consumerism inimical to collective values.”69) But the principal effect is the role of the labor market in the accumulation process. Accumulation requires additional quantities of living labor; at the same time, due to increasing productivity, “it is equally a tendency of capital to make human labor (relatively) superfluous.” Capital thus tends both to “increase the laboring population, as well as constantly to posit a part of it as surplus population—population which is useless until such time as capital can utilize it.”70 Unemployment is a vital part of the process. It ensures the disciplining of the labor force and the functioning of the labor market, and when accumulation stalls, the consequent rise in unemployment tends to lower costs and (other things being equal) raise profits, enabling growth to resume.

When the logic just described prevails across society as a whole, the interests of capitalists come to be identified with the social good per se. Given their monopolization of the means of production and the permeation of economic life by the logic of profit, the profitability of capital comes to appear as a necessary condition for the satisfaction of all other interests. Without profitable enterprises there will be no investment, no employment, no taxation, and no money for workers to pursue their goals. When growth accelerates, therefore, the changes ramify throughout society: workers tend to earn higher wages, states tend to receive higher tax revenues, corporations and household are more likely to be able to repay debts, and investors tend to achieve higher returns.71 Conversely, when growth turns to contraction, trepidation is felt by all. If profits cannot be made, businesses are less likely to employ additional workers and will fiercely resist wage rises. The public are therefore motivated to support political parties and actors that promise to increase growth, in the hope of achieving higher remuneration—the material compensation for labor and symbol of social recognition.

A final factor that conditions the growth imperative is the external relations of states. In a capitalist system, states take responsibility for supervising conditions propitious to capital accumulation and, as such, are as “subordinated to the imperatives of the competitive accumulation of capital as any trader, factory owner or proletarian.”72 The growth imperative is transmitted to states at domestic and international levels, for they are dependent via taxation upon domestic capital accumulation and, simultaneously, are pitted in competition against rivals. A state that fails to secure the conditions propitious to economic growth is likely to be punished—by bond markets and international financial institutions, or political-military dragooning by other states—or destabilized, as social conflicts intensify over a shrinking national product.

In the above I have drawn upon Marx to present growth as an economic imperative specific to capitalism. It should not be conflated with what is sometimes referred to as Marx’s Promethean celebration of abundance or, relatedly, his concept of productive forces. If Marx advocated a Promethean relationship to nature this was not a commitment to GDP growth but to a conception of human beings as a world-transforming species, one whose social activity manifests a continual striving to overcome its own limitations. As regards his celebration of abundance, the most oft-quoted passage is from the Critique of the Gotha Programme. It reads thus: “When the individual is no longer subordinated within the division of labor,” and when, “in the train of the all-round development of individuals their productive powers have also increased and all the springs of cooperative wealth flow more strongly—only then can . . . society inscribe on its banner: from each according to his ability, to each according to his needs!”

This is my translation, for the standard one is slightly misleading. It reads: “ . . . after the productive forces have also increased with the all-around development of the individual, and all the springs of cooperative wealth flow more abundantly—only then [etc.].”73 The differences are subtle but significant. In the original German the “productive powers” cannot be understood as abstract technologies but are unambiguously embodied in human beings, while abundant (or “more cooperatively wealthy”) production is only one of the preconditions of a communist society.

Historical progress, for Marx and Engels, is the development of human beings as a social and natural species. According to Denis Mäder, they identify two key criteria.74 One is politics, including social movements and political consciousness, i.e., human beings’ recognition of their collective power to strategically intervene in the course of their history. The other is the development of human productive forces. In Marx’s analysis of capitalism he tends to assume this to be roughly synonymous with the increase in labor productivity, but it is a term with a variety of referents and should not be equated with material economic growth.75 Essentially, it denotes the ways in which human beings work upon nature, developing their capacities and producing goods and services to fulfil their needs and wants. It refers to workers, their skills, knowledge, and techniques, their ability to cooperate and their scientific knowledge, the technologies they deploy and the resources and other conditions they find in the natural environment.76 Together, these determine the productivity of social labor, and the ability to deploy natural resources to human ends. The purpose of production, in this prospectus, is not mere material goods but “the universality of individual needs, capacities, pleasures, productive forces, etc.”77

Marx contrasts these goals with what would nowadays be called the “growth fetish” that arises within capitalist society, whereby production appears “as the aim of mankind and wealth as the aim of production.”78 Under capitalism, he and Engels argue, the productive forces receive “a one-sided development only,” and become “for the majority, destructive forces.”79 Alongside the impressive “industrial and scientific forces” that capitalism had summoned into being, there exist simultaneously

symptoms of decay, far surpassing the horrors of the latter times of the Roman Empire. In our days, everything seems pregnant with its contrary: Machinery, gifted with the wonderful power of shortening and fructifying human labor, we behold starving and overworking it. The new-fangled sources of wealth, by some strange, weird spell, are turned into sources of want. . . . At the same pace that mankind masters nature, man seems to become enslaved to other men or to his own infamy. . . . This antagonism between the productive forces and the social relations of our epoch is a fact, palpable, overwhelming, and not to be controverted.80

According to this infernal dialectic, even the mastery of nature turns into its opposite. “All progress in capitalist agriculture,” as Marx put it,

is a progress in the art, not only of robbing the workers, but of robbing the soil; all progress in increasing the fertility of the soil for a given time is a progress towards ruining the more long-lasting sources of that fertility. . . . Capitalist production, therefore, only develops the techniques and the degree of combination of the social process of production by simultaneously undermining the original sources of all wealth—the soil and the workers.81

These arguments are central to Marx and Engels’ prognosis for social transformation. The development of the productive forces not only enhances the capacity of human beings to freely and collectively determine their fate but also, by entering into contradiction with the relations of production, yields the possibility of social revolution. This thesis does not entail the claim that people have an interest in their “unfettered” development regardless of environmental cost. For the motivating interest that Marx and Engels ascribe to people in replacing capitalism with communism is an interest in their own welfare, and that of human society generally, which self-evidently requires a habitable planet. Their enthusiasm for the expansion of human needs and powers, moreover, is perfectly compatible with a reduction in resource throughput. Indeed, in the Communist Manifesto they suggest that the productive forces had already reached the stage at which the desired transition of mode of production could succeed. This does not imply that living standards should be dialled back to the 1848 average. Rather, that the striking of a judicious and sustainable balance between material living standards and ecological limits requires progress in human beings’ collective capacity to directly shape their society, as discussed above, and that the expansion of human productive powers is not synonymous with, but constrained by, capitalism’s growth imperative.

Evolution of the growth paradigm

As outlined above, the growth imperative belongs to the genetic code of capitalism. It also operates ideologically. The growth paradigm—the doctrine that economic growth is good, imperative, essentially limitless, and a matter of pressing concern for society as a whole—provides ideological cover for what is the hidden goal of capitalist production: the self-expansion of capital. This ideology is unique to a society based upon commodity production, for it is only in such a society that the drive to accumulate capital is systemically imperative. From this vantage point it is instructive to trace its development. It evolved incrementally, in tandem with capitalism, but certain moments were critical.

One such moment occurred in seventeenth-century England. The conjuncture was defined by the primitive accumulation of capital: rapacious colonial adventures, enclosures and the expropriation of peasants, the amassing of commercial wealth and the ascendancy of merchants. These processes underpinned two others: the scientific revolution and the discursive invention of the economy as a law-governed system. The scientific revolution and the invention of the economy went hand in hand. From the conception of the universe as a machine it was a short step to envisaging society and economy as determined by lawful regularities akin to those that govern the natural world. Philosophers such as John Locke began to refer to the exchange process as an independent causal mechanism, while Dudley North claimed to have identified its ability to maintain itself in equilibrium without external control.82 The market, according to economists such as North—a perspective later elaborated by Richard Cantillon and Adam Smith—is a self-equilibrating system with, at its heart, the self-adjusting price mechanism functioning to maintain the supply of commodities in balance with demand. The economic machine, it was postulated, works in an orderly and predictable manner to produce results that could be defined as subject to laws (in the novel, seventeenth-century sense of “regularities”).83

How did this emergent understanding of the economy relate to the ideology of growth? Mercantilism existed on the cusp between an old world that did not know the growth paradigm and the new, which did. Many of the ambient economic ideas in mid-seventeenth-century England would have sounded familiar to denizens of ancient civilizations. For example, the mercantilists identified economic self-sufficiency as an idealised policy goal to be pursued through commercial and colonial expansion and maritime imperialism. Ancient Athens had long ago demonstrated how these apparently contradictory principles (self-sufficiency and commercial imperialism) could seamlessly cohere. Also like the ancients, mercantilists perceived trade and the market not as mechanisms embodying a logic of infinite expansion but as mechanisms of appropriating and redistributing finite resources. Charles Davenant put it this way: “[T]here is a limited stock of our own product to carry out, beyond which there is no passing: as for example, there is such a quantity of woolen manufactures, lead, tin, etc., which over and above our own consumption, we can export abroad, and our soil as it is now peopled, will not yield much more.”84 Nor did the mercantilists differentiate themselves from ancient economic reasoning in their wrestling with the question of what constituted the nation’s wealth and how to expand it.85 They saw the wealth of a country, a city, or a colony as consisting above all in its people: their number, diligence, and aptitude for work.86 Although bullion may function as the measure of trade, the “Spring and Original of it,” opined Davenant, is the natural product: the “wealth of all nations” is determined by the number, skills, and “Labor and Industry” of its people, alongside the qualities of their ports and soil.87

However, in the same century several new notes made themselves heard. One was voiced in connection with a deepening conviction that government should play a central role in managing the welfare of the mass of the population. This was part and parcel of the project—soon to become central to classical political economy—of altering the social division of labor so as to create and consolidate a mass proletariat.88 In this regard a central priority was to ensure that the masses were kept at subsistence level. For Locke (and after him Daniel Defoe, Bernard Mandeville, Adam Smith, and beyond), the attempt to address the problem of poverty had to center not in institutional-juridical reform but in the economic field, through promoting labor productivity and accelerating the growth of commerce.89 A second new tune pertained to imaginary infinite wealth; it was played most innovatively by the Puritan economist Nicholas If-Jesus-Christ-Had-Not-Died-For-Thee-Thou-Hadst-Been-Damned Barebon (or Barbon for short). He theorised the supply of wealth as infinite: the wealth of a country is “perpetual, and never to be consumed.” For the “Beasts of the Earth, Fowls of the Air, and Fishes of the Sea, Naturally Increase: There is Every Year a New Spring and Autumn, which produceth a New Stock of Plants and Fruits. And the Minerals of the Earth are Unexhaustable.”90

Labor, Barbon asserted, forges boundless wealth from the infinitely renewable resources of the earth. Up to this point, his speculations were not fundamentally new. But he welded them to a novel argument from liberal economics. Given the infinitude of supply, trade is vital in order to carry away the surplus production, and if it does not, the “Labor and Industry of the People” will grind to a halt—for trade is “like the blood through the heart, which by its motion giveth life and growth to the rest of the Body.”91 In this way, Barbon’s cosmology of plenitude underwrote a pioneering liberal theory of free trade. He was able to establish this connection because he could feel the chrematistic pulse of the emergent capitalist order—and it was a rhythm that contrasted glaringly with the dominant value systems of precapitalist orders. For Aristotle, chrematistics represented a threat to the polis, an essentially cancerous process of the self-reproduction of useless, even dangerous, cells within the body politic. For modern political economy, from Nicholas Barbon (and Dudley North, Boisguilbert, etc.) onward, it represented an opportunity, indeed a necessity: the principle of circulation through the economy’s arteries and veins, pumped by the insatiability of human appetites for material improvement, without which doom was certain. A ceaseless chrematistical cascading, Marcel Hénaff has suggested, is definitive of the phenomenology of capitalism, with the economic process coming to figure metonymically as the “certainty of progress.”92

Progress itself represented a third new note. In part, it represented the translation into philosophical language of the campaigns for “improvement” that had gained ubiquity in agrarian-capitalist England and France. In part, it represented a response to the conquest of the New World. The question of what to make of the “primitive” peoples “discovered” there, and what implications followed from their property arrangements, Ronald Meek has argued, may have been the most immediate spur to the development of the Enlightenment concept of progress.93 The discoveries encouraged a new conceptualisation of the human story as a history of social progress: if “they” are at the primitive stage, had “we” once occupied it, too? If so, how had “we” progressed from there to here, from then to now? With the original stage of humanity imagined as primitive and contemptible, the conceptual environment was created for the liberal-imperialist “four stages” model of progress, one that combined universalism with the assumption of European command and control. The philosopher credited as the first to have broken decisively with the idea of historical development as cyclical and to have posited instead the doctrine that human knowledge progresses historically, as if by natural law, in an ongoing and unlimited way, was Bernard de Fontenelle (in 1686) and it is no accident that he identified Columbus’s “discovery” of America as the event that decisively proved Europe’s technical genius vis-à-vis the benighted natives of that continent.94 “Recollect the situation of America before it was discovered by Columbus,” he wrote. The minds of its inhabitants were mired in “profound ignorance; far from having any knowledge of the sciences, they were not even acquainted with the most simple and necessary arts.”95 And yet, while this proved Europeans’ superiority over the global hoi polloi, he pictured Europe’s genius within a dynamic process. “Our knowledge is progressive”; it is continuing—and it may well be that the inhabitants of the Moon, he speculated, functioned at a level as far above Europe as Europe did above America.96 (That he viewed with nonchalance the prospect of a lunar Columbus “discovering” Earth tells its own tale of early-modern genocide denial.) Fontenelle’s progress narrative focused upon the accumulation of knowledge, but over the following century its scope broadened out to encompass human conduct more generally, including morality and the institutions of government and economy.

The next major steps in the march of the growth paradigm were taken by the physiocrats, and then Smith. The physiocrats subscribed to the Enlightenment belief that social processes follow a natural course unless interfered with—akin to the principle of inertia in physics formulated by Galileo and Newton. By analogy, they “deduced” a set of political-economic laws: that a harmonious society depends upon the reproduction of wealth; that although it is government that “gives motion to the springs of society” and “arranges the general order”97 (just like God vis-à-vis nature), government must nonetheless allow the natural laws of the economy to run their course without hindrance, intervening as little as possible in private affairs. Crucially, the physiocrats identified the increase in wealth as the defining measure of whether or not natural law (and thereby the Supreme Being’s will) was being followed. In this way, they knitted Newtonian physics together with a utilitarian devotion to economic growth to provide justification for an economic system based upon private property and free trade.

In Smith’s Wealth of Nations the growth paradigm achieved further definition. Indeed, his status as the founding father of modern economics is, William Barber observes, due to the fact that he was “concerned with developing a theory of economic growth.”98Wealth of Nations begins by stating, as axiom, that a straightforward relationship exists between the nation’s welfare and the quantity of goods and services produced, relative to population.99 In theorizing growth, Smith’s starting point is individual self-interest.100 “The uniform, constant, and uninterrupted effort of every man to better his condition,” he wrote, is the principle from which all “opulence” is derived, and underpins “the natural progress of things toward improvement.”101 “Every individual,” he wrote in a celebrated passage, endeavors “to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value.” Hence, “every individual necessarily labors to render the annual revenue of the society as great as he can.” In acting thus, “he intends only his own gain, and he is in this. . . led by an invisible hand to promote an end which was no part of his intention.”102 With this, we arrive at Smith’s second argument. Once commerce has taken root, it encourages the development of the division of labor, and this enables specialization, yielding productivity gains and further market expansion. The third feature of Smith’s understanding of growth is that it is driven and coordinated by capital investment. Borrowed from physiocracy, his concept of capital denotes money laid out on equipment (fixed capital) and on wages in order to generate revenue. As with the physiocrats, it is built into a model of expanded reproduction in which the entire economy is envisioned as if it is a gigantic farm.103 Following Turgot, Smith “singled out capital as the connecting principle binding together various factors contributing to growth to form a coherent system. As a result, the link between growth and the accumulation of capital was highlighted and other factors contributing to growth were taken into account through their links with capital accumulation.”104 With the introduction of the concept of capital in the work of Turgot and Smith, Renee Prendergast has shown, the hitherto dominant conception of material progress, according to which each generation builds its history on foundations of knowledge, technology and institutions inherited from the past, was transposed into one in which “the accumulation of capital was the driving force of development.”105

Smith did more than anyone to elaborate a conception of economic growth as natural, self-reinforcing, and an unqualified good. Growth stimulates human intercourse and learning, and it satisfies and expands material needs by encouraging the invention of new conveniences, raising wages and rents, lowering profits, and employing the industrious poor. It is democratic, and benefits all social classes alike. The “progressive state”— Smith’s term for a society enjoying rapid economic growth—is “the cheerful and the hearty state to all the different orders of the society,”106 and it is in such a state that workers, enjoying rapidly rising standard of living, are most content.107 Further, the growth of a nation’s wealth was essentially synonymous with capital accumulation.108 However, Smith did not hold that the drive to “improvement” was infinite. His advocacy of self-sustaining growth was tempered by his belief in its self-limiting dynamic, rooted in the natural tendency of profit rates to fall, given the heightened competition that results when the stock of capital expands.109 He believed that some countries (he mentions China and Holland) may already, in the eighteenth century, have acquired their “full complement of riches.”110 Although he did not advocate this as an ideal (for life in a “stationary state” would be dull, and in a “declining” one melancholic111), that he includes these as likely scenarios is significant.

If to modern eyes Smith appears contradictory, a hinge between traditional and modern conceptions of economy, it is because he was a theorist of agrarian capitalism.112Agriculture rests upon cyclical growth and natural limits; capitalism is a system of infinite accumulation. The philosophers of agrarian empires referred to growth principally in connection with plant and animal husbandry; for modern economists growth refers to GDP, business plans, and so forth. Here too, Smith was a Janus figure, he used the term roughly equally in both senses. Indeed, the two usages are hard to tease apart in Wealth of Nations, for its economic growth model employs the simplifying device of assuming a single agricultural commodity, corn.

Smith’s ideas were to splay out via Ricardo to growth boosterism, and via John Stuart Mill toward a patrician growth scepticism. And socialist and conservative traditions were equally able to find inspiration in his work. Smith had provided detailed grounds for poor and rich alike to hitch their wagons to economic growth: the poor, as beneficiaries of growth through rising living standards; the rich, as the principal creators of demand and the enlightened stewards of civilizational progress. This is why, from Smith, a radical current in political economy could wend via Paine and Sismondi to the Smithian socialism of William Thompson et al., while a liberal-conservative route proceeded via Burke, Ricardo, and Malthus through to Hayek and Samuelson. Relatedly, Smith’s argument that growth produces wage growth was seized upon by radicals and liberals alike. For the former, it justified demands for wage rises, and, much later, served to ease the accommodation of social democracy to the capitalist system. For liberals it was rolled out whenever the poor needed to be put in their place. For example, in the turbulent 1790s an English admirer of Smith, the utilitarian philosopher Archdeacon Paley, cautioned the lower classes who found inspiration in the French Revolution that the only change they ought to wish for “is that gradual and progressive improvement of our circumstance which is the natural fruit of successful industry; when each year is something better than the last; when we are enabled to add to our little household one article after another of new comfort or conveniency, as our profits increase, or our burden becomes less.” This, he admonished, “may be looked forward to, and is practicable, by great numbers in a state of public order and quiet; it is absolutely impossible in any other.”113 Still other admirers of Smith took growth boosterism in new directions. Alexander Hamilton, to give a notable example, thought highly of The Wealth of Nations and shared many of Smith’s values but argued (contra Smith) that America’s fledgling industry required protectionist tariffs. It was in the interest of a state “with a view to eventual and permanent economy,” he averred, that it “prompts and improves . . . the growth of manufacturing industry.”114

In such ways, by the late eighteenth century several elements of what was to become the growth paradigm had taken shape, but it was still far from achieving its finished form. The focus of political economy had shifted from the wealth of the state to the “factors of production” in general, but a crucial further shift in the direction of abstraction—for which “utility” was the keyword—was still to come. The doctrine of Progress was increasingly thought of in material terms but had not yet been securely bolted to the doctrine of the naturalness, goodness, and inevitability of year-on-year economic growth. Growth was not yet conceived in abstract, quantifiable terms, or as a principal policy goal for governments. Nor was there a clear-cut conception of the object of growth: the economy. These elements all began to come together over the course of the nineteenth century.

One was the idea that the economy exists as a separate sphere with respect to politics, a way of seeing that was found in the work of economists such as Jean-Baptiste Say and David Ricardo.115 Another Ricardian notion was that the logic of diminishing returns, which had cast a cloud over the growth predictions of the classical economists, could be postponed to the “almost indefinite future” by technical progress and spatial fixes such as “foreign trade and the exploitation of the almost limitless resources of the extra-European world.”116 The same century witnessed that limitless world become integrated into the Western world-system, and with this a new geography of power came into being, a relational geography in which the power and status of the advanced powers depended decreasingly upon territorial sway and increasingly upon economic success—soon to be conceived of as growth.117 The new geography of power spoke to the interests of US imperialism, but it also dovetailed with the new neoclassical understanding of the economy, as a field of market competition divorced from specific material processes.

The neoclassical economists subscribed to the Whiggish assumption that, in William Jevons’ words, it is not merely wealth but “growing wealth that makes a happy and prosperous country,”1118 and the process of growth itself—indeed, of economic activity tout court—was to be framed for the purposes of economic analysis as a strictly quantitative phenomenon. In this, Jevons was the pioneer. All economic decisions, he held, can be reduced to expressions of pleasure seeking and pain aversion (utility vs. disutility; consumption vs. production). Reduced in this way to a utility spectrum, economic behavior was rendered quantifiable and subject to treatment as mathematical formulae. (“Being concerned with quantities,” said Jevons, economics is necessarily “mathematical in its subject.”119) Similarly, the Austrian Carl Menger contributed to the turn of economics from questions of labor and resources towards a preoccupation with the “issue of maximizing satisfaction.” This is why his theory of value—of the underlying basis of exchange relations—is formulated not in terms of substantive attributes, such as human labor or other elements of the natural world, but rather in terms of the subjective calculations that individuals make, “in a context of scarcity and individual property, that they would rather have something that someone else has than all or part of something in their own possession.”120 The other neoclassical and “Austrian” economists, such as Alfred Marshall and Eugen von Böhm-Bawerk, all followed suit. Human beings, according to their models, do not fashion material things but utilities.121

Neoclassical economics created the image of the economy defined by processes abstracted from their material integument. But this did not necessarily entail growth boosterism, and during the heyday of neoclassical economics few professional economists were strong proponents of growth as a policy objective.122 Neoclassical theory had, so to speak, pressed the eject button that propelled economics away from politics and society, but in the process it escaped the orbit of the real world. It was in reaction by institutional economists against this excess that defined the next phase in the evolution of the growth paradigm. Whereas the neoclassicals conceived of the economic space in algebraic terms and by analogy with physics, their institutionalist critics brought a rugged empirical and arithmetical approach, directing attention towards real-world economic facts and testable propositions. Tapping into a tradition of national “Political Arithmetick” that harked back to William Petty, Wesley Mitchell invented “the modern concept of a national income,” and fleshed it out by providing actual numbers which purported to represent the national economy.123 From Mitchell’s germ, and with the assistance of Simon Kuznets, the idea of measuring national income was to grow. It eventually morphed into GDP. In this, the 1930s was the key decade. It witnessed Kuznets’ national income accounting, the attempt by economists such as Colin Clark to uncover what he called “the real laws governing economic growth,”124 and the attempt, also by Clark, to envisage and statistically estimate the annual “rate of growth of real income per head.”125 As Philip Mirowski has detailed, the work of Mitchell’s National Bureau of Economic Research, and Colin Clark and others, “invested the national-income concept with empirical legitimacy, creating a distinct theoretical entity in its own right. This undoubtedly set the stage for Keynes’s decision to base the General Theory upon it.”126

Keynes was a seminal figure in the story of the growth paradigm but he was no simple growth booster. For him, economics ought to be a “moral science,”127 and economic growth should be a means and not an end; he incorporated into his thinking the traditional Christian (or Romantic) disdain for avarice. As society advances, he believed, motives of material gain would fade, yielding their place to concerns of an ethical and religious nature. He also held that the rate of profit would tend to decline as capital became less abundant, inaugurating a less exploitative but slower-growing (or even stationary) phase of capitalism. At the same time, however, Keynesian macroeconomics gave a forceful impetus to the growth paradigm, in particular to the adoption of growth as a policy goal. And, in conceiving of the economy not as “an aggregation of markets in different commodities” but in terms of monetary transactions within the territorial space of a nation state, Keynes helped to facilitate the invention of GDP.128

In short, the first decades of the twentieth century witnessed the construction of a particular understanding of the economy, as a self-contained totality of relations of value, expressed in monetary terms, one that was simultaneously an object, defined, as Timothy Mitchell has argued, “primarily by its growth.”129 Together, the development of national income accounting and the Keynesian revolution of the 1930s marked the final stage in the replacement of earlier conceptions of economic life—as embedded in material processes that could not grow on an infinite basis (“the expansion of cities and factories, the colonial enlargement of territory, the accumulation of gold reserves, the growth of population and absorption of migrants, the exploitation of new mineral reserves, the increase in the volume of trade in commodities”)—by the idea of the economy which, “measured by the new calculative device of national income accounting, had no obvious limit.”130 In contrast to economic thought in the mercantilist era, the economy was now conceived as an abstract totality, the essential movement of which is toward growth, viewed as a goal rather than as a means.131

The rise of neoclassical economics saw “nature” (and “land”) expunged from economic theory, but in the mid-twentieth century nature was brought back in on a new basis, as “natural resources” and “the environment.” In the United States, the Paley Report (“Resources for Freedom: Foundations for Growth and Security”) of 1952 proposed the foundation of an organization tasked to monitor the supply of the natural resource inputs upon which the expanding economy depended. “Resources for the Future” (RFF) was the result. It was the first think tank devoted to the interaction between the economy and its natural resource inputs and environmental externalities. It played a seminal role in constructing the environmental and natural resource challenges in subsequent decades. For the same historical conjuncture that witnessed the consolidation of the concept of the economy as a growth-oriented system also experienced the rise of environmentalist and Malthusian indictments of economic growth: “Silent Spring” in the 1960s, “Limits to Growth” in the early 1970s, and so on. The RFF played an active and effective part in redefining these and similar challenges as “issues” to be addressed via economists’ techniques (notably cost-benefit analysis) and the extension of market mechanisms, within a domain constituted by a new subdiscipline: “environmental economics.”132 For example, pollution was to be understood not as the result of economic growth per se but of a failure to adequately price environmental externalities; it represented a market failure for which the solution was simple: more market. These ideological moves might nowadays be casually filed under neoliberalism but they had been cemented into place by the early 1970s; they were the fruit of capitalism in its Keynesian, or Fordist, phase. (In the case of Fordism the link is also literal: RFF was funded by the Ford Foundation.) They suggest that the green economy view of nature and the environment, discussed above, represented a radicalization of the previous way of seeing, but not a rupture.

Conclusion

The vision offered by green growth is beguiling: a lush, eco-balanced affluence engineered through ethical enterprise and smart markets. It is also, this essay has argued, a smokescreen. It is a red herring, a pink elephant, a delusion; it is a strategic mirage, a pied-piper panacea that seduces even critical spirits into complicity with capitalist hegemonic projects that do little or nothing to repair humankind’s relationship with the environment. (South Korea’s Green New Deal is a gigantomanic case in point.) But what is the alternative? Is it, as Elliott suggests, to fritter away our activist lives in a futile attempt to hector the citizens of New Jersey, New South Wales, etc., into acquiescing to a relentlessly declining quality of life? There are reasonable grounds to think not. Coalitions of movements resisting the manifold aspects of capitalism can be constructed. The struggle for a habitable future, as Naomi Klein has put it, could become “a catalyzing force for positive change,” entailing a pushback against corporate influence over democratic government, the rewriting of trade deals, the return to public ownership of essential services such as energy and water, and investment in infrastructure such as public transport and the energy-efficient refurbishment of buildings.133 In the Global South the list could be extended to include electricity supply for the 1.6 billion people who lack it, an end to backbreaking labor, and the installation of sanitation and water systems. Food for the hungry and malnourished, jobs for the workless, high-quality public transport and health care, clean air: for most people (including the inhabitants of New Jersey, et al.) such rewards would surely compensate for any reductions which a society that respects planetary boundaries would ordain. Overall, a transformation of this sort would expand the output of certain goods, while reducing the consumption of others (air miles flown, SUV ownership, beef consumption, and the like). The latter would disproportionately affect the well-heeled, contributing to another bonus: a reduction in levels of inequality within and between nations.

Few critics of the growth imperative go so far as to identify capitalism as its effective cause, but many perceive connections between the growth imperative and one or other of its facets: its corporate sector, for example, or its dependence upon credit relationships. As I have argued, the growth imperative and its accompanying ideology are best understood of products of capitalism; they evolved in tandem with it. In precapitalist societies commitments to certain forms of wealth expansion and technical improvement were advanced by various forms of organization and corporate group, but only in capitalism has the growth paradigm become hegemonic. For a system that operates through the reduction of heterogenous use values to abstract exchange value in the process of accumulation, the ideology of growth is peculiarly appropriate. The growth fetish appears as commodity fetishism at one remove, the growth imperative as the accumulation imperative at one remove. Economic growth comes to assume the appearance of an indispensable objective necessity, society’s lifeblood. As such, it serves to naturalize and sanctify the prevailing social order, affirming it as the giver of sustenance, the one plausible good and rational mode of organizing social existence. The ideology of growth translates the class interests of the bourgeoisie into what Marx and Engels called the “form of universality,” and its success in this regard is the degree to which it succeeds in presenting itself as non-ideological: “as natural, logical, evident, or as so-called neutral science or technique.”134 So ingrained has it become that even when existentially threatening growth-related environmental problems loom, the program for their alleviation assumes the form of green growth.

Epilogue