The end of the “Golden Decade”

This article originally appeared on Socialismo o Barbarie1, the Web site of the Argentinian socialist organization, El Nuevo MAS (Movimiento al Socialismo). It is translated and reprinted here with the author’s and publisher’s permission.

Translated by Lance Selfa and Tom Lewis.

Introduction: Some propositions

The most important point about the current state of the Latin American economy is to establish the end of the commodity-price boom, a change in the terms of trade between prices of imports and exports, and the closing of the economic development gap between the core capitalist countries and “emerging markets.” More tentatively, but no less profoundly, some are questioning the relative, but real, process of social progress and poverty reduction over the last decade. The full force of the economic, social, and political consequences of this definite “end of an era” in Latin America still hasn’t been felt. But according to all economic analysts of whatever stripe, the level of investment from that period has plateaued, and will stay at that level for a while.

In truth, the commodities boom lifted millions of Latin Americans from extreme poverty, and new middle-class sectors and the center-left governments both sustained and benefitted from this process. But it produced something else as well. For many of these governments (and, to a certain extent, for the political climate of their respective societies), it provided a supposed material base for the case that the world was becoming “increasingly multipolar”. This represented a shift away from the classical (and Marxist) understandings of a world shaped by the contradiction between imperialist countries and countries exploited by imperialism.

This vision of a zero-sum world—where, over time, the gap between the developed core and the underdeveloped periphery tends to expand, making it structurally impossible for these countries to catch up to the developed ones—threatens political currents and governments like those of Chávez-Maduro, Evo Morales, Correa, the Kirchners, etc., for a simple reason. None of these governments, beyond tough talk from some of them, truly challenge the imperialist capitalist order. At most, they hope to reposition their countries in that global order on more equal, and less humiliating, terms. Above all, they seek to preserve a margin of independent room for maneuver, while accepting and legitimizing—rather than opposing and fighting—globalized capitalism.

The image of a global, less oppressive, capitalism—one with imperialist countries, but also with a periphery able to sustain its own political and economic development without interference from the central capitalist powers—had, for over a decade, an apparent material base. Between 2000 and 2010, the combined economic growth rate of “emerging” countries, even excluding China, was more than 4.5 percentage points higher than the US growth rate, leaving aside the rest of the developed world. As The Economist put it:

Were the emerging world able to maintain a 4.5-percentage-point growth advantage over the rich world, then other things being equal its average income per person would converge with that in America in just over thirty years: scarcely a generation. Such a convergence would represent an historic change rivalled in its scope only by the extraordinary industrialization that opened the global gaps between the rich and the rest in the first place, and completely unprecedented in its pace.2

Put in Marxist terms: the continuation for thirty years more of faster growth in the periphery than in the core would have equalized per capita incomes between the poor and rich countries, and would have meant the end of imperialism, both in theory and in reality.

But this didn’t happen.

We’re now in the midst of a “return to normalcy,” in several senses. As The Economist noted with glee, the “catch up” of the less-developed countries to the more developed countries, which took place over a decade, “was an aberration.” It was aberrant not in a moral sense, but in a scientific one. In other words, it was a “deviation from the norm,” or put more simply, an anomaly.

As The Economist pointed out in a subsequent article:

It was great while it lasted. In a golden period from 2003 to 2010 Latin America’s economies grew at an annual average rate of close to 5 percent, wages rose and unemployment fell, more than 50 million people were lifted out of poverty and the middle class swelled to more than a third of the population. But now the growth spurt is over. . . . Latin America is decelerating faster than much of the rest of the emerging world.3

In other words, the “catch-up” perspective, which had captivated the region’s governments, economists and technocrats (and those of other underdeveloped regions), and had sustained the fantasy of “increasing national sovereignty in a multi-polar world,” gave way to the reality of the normal dynamics of core-periphery relations. If the golden decade of “tailwinds” promised a catch up in thirty years given a 4.5 percentage point gap in growth rates favoring the emerging economies, the 1.1 percentage point advantage registered in 2013 (2.6 percentage points if we include China) promises a catch up in 115 years. In 2014, the emerging economies’ advantage declined to .39 percentage points. “That would put off full convergence for more than 300 years—indistinguishable from never as far as today’s societies are concerned.”4Sic transit gloria emergenti . . . so goes the illusion of a capitalist world equalization based on only one decade’s experience. That period can seem long for a generation or for political currents with little strategic vision, but it’s a blink of an eye for the solid and stable configuration of imperialist capitalism.5

Isn’t that an exaggeration? Are we falling into the same error that the Latin American governments did—that of generalizing from a specific, and changing, conjuncture of events? Isn’t it possible that the periphery, in general, and Latin America in particular, will return to sustained growth, at rates higher than those of the developed countries?

That’s not what the last three years’ economic data indicate. Perhaps it’s more relevant to consider today’s sluggish growth rates to explain how exceptional and contingent the previous boom was. The Economist again:

But the things which made that period exceptional cannot be replicated easily, if at all. . . .The great expectations raised over the last half-generation look increasingly likely to be dashed. . . . Another was rapid growth in commodity prices; many emerging economies rely heavily on natural resource exports. But the biggest push—which was not unrelated to the commodity-price boom—came from global trade. . . . A great deal of this was due to the rise of China as a manufacturing superpower, but that was far from being the whole story. . . . The lion’s share of this growth was due to China. During this phase of what Arvind Subramanian and Martin Kessler, of the Peterson Institute for International Economics, call “hyperglobalisation”, China’s trade became so important that it was critical not just to its own economy but to that of the world as a whole. The only previous economy of which that could be said was 19th-century Britain’s. But trade went up across the board, too. . . . There are also fears that rapid catch-up might have meant shallow catch-up of a sort that could never be sustained. 6

The explosive industrial transformation of China, and the rise in commodity prices that accompanied it, lifted other emerging economies. But that was a one-time phenomenon. China can’t go back to zero and industrialize again.

This new context underpins the gradual, but discernible, change in orientation of the Latin American governments, especially among those countries most exposed to unfavorable conditions. They are looking for another macroeconomic balance and support for their current accounts, accepting that their export income will decline with declining commodity prices, and that they will receive less foreign investment.

That said, it’s necessary to lay out a second proposition: the end of the decade of growth in Latin America doesn’t represent a return to the same starting point nor to the onset of catastrophe. What was gained over more than a decade won’t be lost in two years. In general terms, the region’s countries are more able to resist headwinds due to a series of developments and policies that act as shock absorbers against external crises. Neither is the world unchanged. Above all, the overall Latin American economy, while facing difficult times, isn’t about to fall off a cliff.

Among others, we’ll mention the following:

First, a number of countries in the region have taken advantage of the positive miniperiod to improve their international financial posture. We can see this on two levels: an important accumulation of foreign exchange (with wide differences, given that this isn’t the case in Venezuela and Argentina), and a stronger position in relation to foreign debt. The decline in the debt burden stems from a number of policies, among them longer repayment terms, lower interest rates, and a reduction in the proportion of debt denominated in foreign currency. This last factor has made the debt easier to service and refinance, and less subject to currency fluctuations. These chronic and structural problems for dependent countries haven’t been eliminated, but they have been attenuated, at least for the short term.7

Second, the region’s export boom has lost steam. In fact, in the last three years, it’s virtually stagnant. But there hasn’t been a drastic drop in levels of either trade or income. It’s more accurate to say that the upward curve in trade over the last ten years—powered by demand, high prices and good terms of trade—has leveled out. What’s more, as we will see, Latin America’s export profile has not overcome its historic problems. In truth, the good times deepened the region’s historic imbalances with the rest of the capitalist world, in terms of its dependence on raw material exports and capital goods imports.

The third factor to consider is what we said about this period’s “legacy.” The role of China as a trading partner—second only to the US, and ahead of the European Union—has been decisive. This factor has altered, in palpable ways, the geopolitical balance in the region. Although China-Latin American relations began with trade, they have extended to other more strategic areas, from financial to military aid.

Once we weigh these factors (which aren’t the only, but we believe are the most important, ones), we must say that the current conjuncture, or perhaps the period, that is beginning in Latin America is clearly one of greater difficulties and fewer easy solutions. Recognizing that this will differ by country, external pressures toward neoliberal adjustment will increase. Although we must evaluate the impact that European anti-austerity governments might have on the general picture, the economic future of the region will be closely tied to a political variable: the course that the center-left Latin American governments take. Dilma Rousseff’s second term in Brazil is already showing signs of a shift to the right and of adopting “orthodox” policies of adjustment. We will have to continue to pay attention to these. The upcoming change in the Argentinian government and the profound crisis of the Venezuelan state—government and economy—can tip the balance: either to preserving a balance of forces more to left than the rest of the world, or a shift (of unforeseen rhythm and depth) to a “new normal” closer to that which persists in other parts of the world . . . if Europe doesn’t upset the apple cart.

The global context is unfavorable

Paradoxically, the world crisis that opened with the collapse of Lehman Brothers in 2008 and which—in a profound sense, still hasn’t ended—benefited Latin America early on as it pushed China into the undisputed role as locomotive of the world economy. This picture has changed in the last two years, starting with the following developments: a) the recession, or barely perceptible growth, that continues in Europe; b) US growth, which is picking up, isn’t benefitting Latin America much; c) China is showing increasing signs that its dizzying GDP growth, based on a huge expansion of industrial capacity and trade, is giving way to a new stage of less spectacular growth (less than 7 percent annually) with a more moderate import demand (the source of peaking world commodity prices); d) in part, as a consequence, the “emerging markets,” the BRICS [Brazil, Russia, India, China, South Africa] (minus China) and others that have been the motor of the world economy, are performing well below their figures of five years ago; and e) the sharp drop in oil prices, which most analysts believe to be a positive for the overall economy, is hitting exporters hard. Among those is one of the BRICS—Russia—and one of the key countries in Latin America—Venezuela—not to mention Ecuador. We will try to deal with each of these points in more detail.

While the US reacted quickly to arrest the banking crisis caused by toxic assets before turning to quantitative easing (QE), in Europe, the financial contagion took the form of a sovereign debt crisis. The crisis hit bottom at the end of 2011, but in no way can we say that the EU and the Eurozone has escaped its problems. Instead, it appears that the European crisis has become chronic. Until now, it has avoided economic catastrophe, but it hasn’t been able to achieve a real or lasting exit from a stagnation of low growth, quasi-deflation, and unemployment rates that threaten to produce a “lost generation” in the most affected countries.

In 2012, the newly installed president of the European Central Bank, Mario Draghi, cited a threat to the Euro of possible “Grexit” and the deepening of fiscal crises in Spain and Italy when he promised to do “whatever was necessary” to preserve the common currency. On January 22, 2015, Draghi took a serious—although to many, too late—decision to launch a European version of QE, in the face of opposition from the Bundesbank and the German government, standard bearers for orthodoxy and fiscal discipline. 8

Clearly the Europe that arrogantly wants to limit the “irresponsibility” of the Syriza government in Greece hasn’t had much success to show for it. In fact, recognizing the economic stagnation—verging on recession—in several Eurozone countries, the former European Council President Herman van Rompuy warned last November, that “without jobs or growth, the European idea is itself in danger.” At the annual Davos summit of the world’s rich and powerful, one of the main preoccupations was the possibility of a new sovereign debt crisis brought on by the general economic slump.

Germany, the “locomotive of Europe,” grounds its economy on its trade surplus (which has exceeded 7 percent of GDP for the last three years) and fiscal balance. Both of these come at the cost of “internal adjustment” of its Eurozone neighbors, where real salaries have dropped since 2000. Productivity growth is stalled, and the rate of investment is today 5 percentage points lower than it was in 2000.

A series of fundamental global and European problems have yet to be addressed, according to the well-known analyst Martin Wolf. First, the world economy seems incapable of generating an increase in demand that can absorb what it can produce, without resorting to an “unsustainable increase in easy credit” (including the different versions of QE). Second, since the beginning of the crisis in 2008, the ratio of public debt to GDP has increased by 46 percentage points in the UK, 40 percentage points in the US, 26 percentage points in the Eurozone, and 72 percentage points in China, where public debt represents 220 percent of GDP. Each economy is managing its debt in different ways, but one thing is clear: where the weight of the debt represents an immediate problem, as in Europe, the last few years haven’t brought any relief. Third, the Eurozone is hoping for a new surge in growth, and with it more sustainability for the debt, based on an increase in world demand. But this is only viable for the smaller countries—or for some countries—but not for the entire Eurozone. Reaching both objectives—a direct reduction in the debt and strong economic growth—seems very difficult. Policies like QE are an attempt to prop up demand following the collapse of the previous debt bubble, but they are a deal with the devil that is laying the basis for future crisis.

The economist Nouriel Roubini proposes less fiscal austerity, more public investment and less dependence on monetary stimulus. In his judgment, the developed economies have done the opposite, and the result has been a slow global recovery, with different results in the US, Europe, and Japan.

The US is the only Western power that seems to be pulling itself out of the impasse of anemic growth. It is even beginning to create jobs. But this isn’t really helping Latin America. The dollar is strengthening, not only against the Euro but also against other emerging currencies, reflecting expectations that the end of QE will lead to an increase in interest rates. In the six months after QE officially ended on June 30, 2014, the dollar’s exchange rate against the Colombian peso and the Brazilian real increased 15 percent, and it increased by 5 percent against the Mexican, Peruvian, Uruguayan and Argentinian currencies. This should increase the competitiveness of Latin American exports, but, as we’ve seen, the relative weight of the US as a trading partner has declined noticeably, with China picking up the slack. In the past, an increase in the value of the dollar had an immediate impact on stimulating exports from the region. Today, we haven’t seen that.

In truth, one of the main sources of worry for Latin American governments is the economic slowdown in China, which will drop from 7.4 percent in 2014 to an estimated 7 percent in 2015. Any other country would envy these growth rates, but in China they signal, perhaps, the beginning of the “soft landing” for its economy. Citing this, Chinese Prime Minister Li Keqiang announced at Davos that the Chinese Communist Party is embarking on a major economic opening up and a turn to “orthodox,” even neoliberal, policies: “We need to give the market a decisive role . . . The new situation has made structural reform even more necessary. These reforms in China are in line with those of the global economy.” He added another interesting proposition: “The Chinese economy has entered a period of the ‘new normal’” through pro-market “structural reforms” in fiscal and tax policy, exchange rates, and financial markets.

All this took place in 2014 as China’s GDP surpassed the US’s (as measured in purchasing power parity), and as the main destination for foreign direct investment: $128 billion, compared to $86 billion to the US9

By way of comparison, the EU attracted $267 billion (up 13 percent in 2014); Brazil, $62 billion; India, $35 billion (up 26 percent); Russia, $19 billion (down 70 percent); and all of Latin America, $153 billion (down 19 percent). In the context of an 8 percent decline in worldwide foreign direct investment in 2014, about $510 billion of the total of $1.25 trillion went to developed countries, which itself represented a decline of 14 percent in 2014.

This shift explains why those former star economies, the BRICS (besides China)—especially Russia and Brazil—are in the doldrums. About 54 percent of the 200 million unemployed in the world reside in emerging economies, where growth stimulates less employment than in the central countries (with 27 percent of the total of unemployed), according to a November 2014 IMF report. The emerging economies performances had already begun to raise doubts about their capacity to power the world economy, and the report definitely dampens enthusiasm for those countries like Croatia, Argentina, Jordan and Ukraine that had been considered “newly emerging.”

To Latin America, this isn’t a faraway problem. Russia, for example, had begun to appear as a potential player in the region, with China, carving a niche like the EU without directly confronting the US. But Putin’s recent troubles, from the drop in oil prices (and the consequent drop in the ruble and in foreign reserves) to sanctions and the conflict with Ukraine, have undercut Russia’s regional presence. This has left the field open to China to make “unconventional” political/economic alliances, as we will see later.

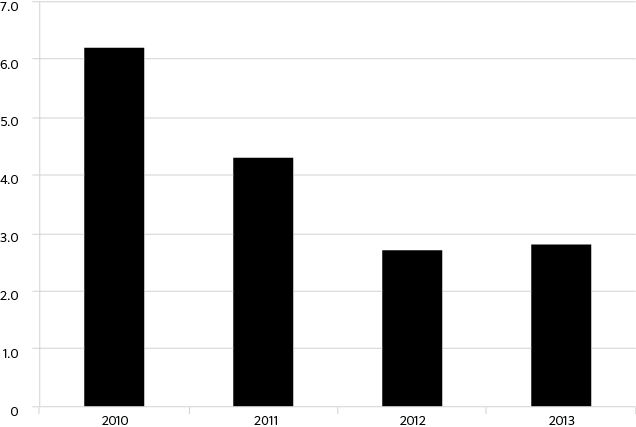

Among the BRICS and especially in Brazil, the dividing line between economic cycles is more clearly visible than it is in the rest. While its GDP grew substantially until 2010 (hitting 7.5 percent in that year), growth in subsequent years has declined to the edge of recession. In 2011, the GDP grew only 2.7 percent; in 2012, barely 1 percent; in 2013, 2.5 percent; and figures for 2014 vary between 0.7 percent (according to the central bank) to 0.15 percent, according to private analysts. The prediction for 2015 is a growth rate of about, at maximum, 1 percent, if the country can avoid recession. David Beker, Bank of America’s chief economist in Brazil, asserts that the country’s “sources of growth are tapped out.” Nevertheless, he applauds all of the neoliberal reforms on taxation, government spending, devaluation and layoffs that the re-elected government of Dilma Rousseff has taken.

This is the context for the pro-market and “orthodox” turn of Dilma Roussef’s government, which took office in early 2015 after a very narrow victory over the neoliberal candidate Aécio Neves. Appointments to all the key government offices were decidedly “market friendly,” beginning with the economics minister Joaquim Levy, who proclaimed 2015 as “a year of economic adjustment and rebalancing to bring back growth,” rhetoric indistinguishable from the neoliberal mantras of the 1990s.

While not trying to provide a full accounting of the Brazilian economy under the Workers’ Party (PT) governments, let’s stipulate that Brazil illustrates the very limited gains and the much greater limits of the “golden cycle” of the last decade. If under Lula’s two terms and Dilma’s first, a quarter of the population rose out of poverty, this didn’t reflect a structural change where “social advances” were rooted in capitalist development, whether as investment in branches of production or in foreign trade. Moreover, what were definitely improvements in terms of income (absolute and relative) for broader sections of the population didn’t change the way that Brazilian capitalism functioned.

In any event, the only thing that the PT governments have “accumulated” is foreign reserves (on the order of $370 billion, almost ten times more than in 2002). These have played an important role in absorbing external economic shocks. But they are far from being an indicator of development. On the other hand, this increase in reserves took place while Brazil’s foreign debt jumped (from $198 billion in 2008 to $313 billion in 2012, according to the ECLAC). Besides, Brazil’s place in the world division of labor is more marked than ever by dependence on its exports of raw materials. Despite receiving an important injection of foreign investment, its national investment hasn’t gone above 18–19 percent of GDP, well below what’s necessary to generate self-sustained growth.

To this, we have to add a period with increasing macroeconomic difficulties. Already, we’ve seen a slowdown in GDP growth (expanding barely 6.7 percent during Dilma’s entire first term), but the trade balance in 2014 tipped into a deficit of $5 billion—the first time the country has run a trade deficit since 2000. Automobile production dropped 15 percent in 2014, the worst result since 1999. As a result, economics minister Joaquim Levy is applying neoliberal nostrums of cutting spending and targeting low inflation and deficits to get Brazil’s fiscal house in order—so that the ratings firms will label Brazil “investment grade.”

The last aspect of the global context to highlight is the drop in the price of oil, which is already creating winners and losers. We can begin to assess its impact on the region.

The long-term drop in oil prices began in June, 2014, when the price of West Texas Intermediate dropped from $107 per barrel to less than $50 per barrel. The price didn’t find a floor, as $60 per barrel gave way to $50, and then $40-45. Industry analysts predict the price crash will last at least through 2016.

Let’s list some of the variables at play. First, Saudi Arabia, the world’s top producer (which has the lowest cost of production, at $6 per barrel), has refused, as leader of OPEC to cut production in order to boost prices. The sudden emergence of the US as a top producer, through unconventional methods like high-cost fracking, and the economic slowdown in China, the world’s top consumer, has disrupted the world balance of supply and demand. World prices have dropped as a result.

The major importers, like China and the European Union (which imported $500 billion in oil in 2013), Japan, and India (which imports 85 percent of all its hydrocarbons), are the first beneficiaries. The recent drop in crude prices would help these economies not only preserve their foreign reserves, but also to eventually increase domestic consumption through lower fuel costs. This could help economic growth overall. Lower oil prices could translate into an increase in world GDP on the order of .8 percent, according to the IMF.

On the other hand, less efficient and high-cost oil producers and exporters (like Russia, Venezuela, Nigeria, Malaysia and Iran) and other energy companies are hit, because low-margin shale oil producers (in the US and other countries) sell at $40-50 per barrel. Another outcome of the oil shock is the decline of global inflation. This factor is a positive and welcome development for the world economy, unlike deflation due to recession, as seen in Europe.

The end of the “party” and its first consequences

The Argentinian economist Mario Blejer, economic adviser to many international and Argentinian agencies and currently executive director of Banco Itaú, summed up the region’s current economic situation in his presentation at the 2015 Davos World Economic Forum: “The party’s over.”

The “party”, based on enormous income from the commodity price boom, and some strong inflows of foreign direct investment, consisted of: a) leaving behind, at least temporarily, the threat of external shocks (debt crises, default, etc.); b) increasing income to the state, thus providing some room for maneuver to the region’s self-proclaimed “anti-neoliberal” governments; c) boosting the incomes of wider sections of the population through better-quality jobs and subsidies; and d) as a consequence, and measured against neoliberalism’s attacks on living standards elsewhere, providing political stability to the “center-left” governments that dominated this new political cycle. In fact, all of them were re-elected.

Nonetheless, as we and other analysts have argued, this relative (and in some cases absolute) improvement in living standards wasn’t the result of structural change—certainly not in any socialist sense, but not even on the “developmentalist” path that mid-twentieth century bourgeois nationalist governments promoted. All of these governments, of whatever stripe, shared a common trait. None of them changed in any profound or lasting way the operation of their capitalist economies. The change they brought about, when there was any, occurred at the level of income distribution, not in the organization of production.10 The “party” to which Blejer referred wasn’t a mirage, but a tangible reality. To grasp the huge increase in income, and the consequent economic and political advances during the “golden decade,” let’s take a look in Table 1 at a single country, Bolivia, under the government of Evo Morales.

|

Table 1. Bolivian macroeconomic data, 2005-2014 |

|||

|

|

2005 |

2014 |

Ratio of 2014/2005 |

|

Gross Domestic Product (in billions of U.S. dollars) |

9.5 |

30.4 |

3.2 to 1 |

|

Foreign reserves (in billions of U.S. dollars) |

1.7 |

15.4 |

9.1 to 1 |

|

Exports of natural gas (therms) |

1,400 |

6,800 |

4.9 to 1 |

|

Price of natural gas (dollars per million BTUs) |

$2.50 |

$9.30 |

3.7 to 1 |

|

Foreign direct investment* (in billions of U.S. dollars) |

.2 |

1.73 |

8.7 to 1 |

|

State income from natural gas (in billions of U.S. dollars) |

.678 |

5.855 |

8.6 to 1 |

|

*At the height of a wave of privatizations in 1998, foreign direct investment was $1.02 billion. |

|||

|

Source: Author’s calculation from data from the United Nations Economic Commission on Latin America and the Caribbean (hereafter referred to as “ECLAC”) and the Bolivian Central Bank. |

|||

The third column in the table shows the change in less than ten years, and could explain on its own, the material base for the Morales government’s continuity and political stability. What stands out is the increase in the price of natural gas. Although this lies outside of Bolivia’s or any other government’s control, it underpins the sharp increase in all of the other indicators. If that decisive factor moved in the other direction, its impact on the region’s macro economy couldn’t be underestimated. That is happening today, with all of the predictable knock-on effects.

If the golden decade had such a profound impact on the region’s economic statistics, let’s see what impact it had on statistics measuring social wellbeing. Consider the summary in Table 2.

|

Table 2. Poverty and extreme poverty in Latin America, 2002-2012 |

||

|

|

Poverty, millions of people |

Extreme poverty, millions of people |

|

2002 |

225 (43.9) |

99 (19.3) |

|

2009 |

184 (32.8) |

73 (13.0) |

|

2012 |

167 (28.8) |

66 (11.4) |

|

Note: Poverty is defined as having an income too low to satisfy basic necessities; extreme poverty is defined as having in income too low to meet basic nutrition requirements.. Source: ECLAC. |

||

It’s not surprising that the biggest drop in poverty took place precisely in those “party” years when commodity prices were rising. Note also, that the trend slows in the most recent three-year period, although it doesn’t reverse. What we can begin to see is a moderate, but perceptible, tendency toward an increasing concentration of income, and an end to the “egalitarian” phase of the commodities boom. The explanation for this lies in “lower growth in labour income at the bottom of the income pyramid; [and] less effective social assistance (either through fiscal constraints or changes in targeting),” according to UN economist George Gray Molina. “The culprit would seem to be the labour market—particularly the low-skilled segment of the labour market in the service sector which created most of the new jobs during the boom.”11

In addition, the economic “model” of governments born of the cycle of the late 1990s and early 2000s fostered popular rebellions concentrated on changing income distribution, and not on changing the economic structure or their country’s insertion into the world market. So, unlike even the pretensions of peaceful and gradual transformation within capitalism that the old developmentalist model promoted, today’s “progressive” governments were incapable of any substantial change in their countries’ economic structures.

Despite a decade of high commodity prices, none of these was able to take advantage of this “manna from heaven” to reduce their dependence on commodities, the main source of income from trade. In fact, dependence on commodity exports increased, and the governments aimed to capture for the state a larger portion of income that, in the 1990s, would have remained within the circuits of large, private exporters (both national and, above all, international). This served the governments’ redistributive agendas, but it had no connection to any development plans, even capitalist ones.

Likewise, these governments’ strategic visions were much more limited than that of the classical bourgeois nationalist governments of the 1950s and 1960s. They didn’t even propose a “model of development” that left capital untouched. Rather, they barely managed the huge income from commodities, and dedicated it mainly to income redistribution that supported their electoral aims. In brief, the sum total of their economic strategy was guaranteeing their political support by “delivering the goods” to the electorate. If this brought real benefits to ordinary people indirectly (with real, but limited, economic transformation that, for example, increased the number of higher quality jobs) or directly through “populism” (with direct or indirect subsidies), it matters little. Governments took the path of least resistance, and often this was the “populist” path.

Without transforming the productive structure, the default is to rely on traditional primary goods, the main source of foreign exchange. That dependency on commodity exports left almost every country exposed to sudden price fluctuations within a secular tendency (interrupted by the “golden decade”) of deterioration in the terms of trade. More seriously, these imbalances tend to reproduce themselves, and get in the way of any attempt to rebalance economies by promoting a stronger industrial sector, using technology less dependent on foreign suppliers. On the contrary, in an example of combined and unequal development, the small number of high-tech sectors in the region is concentrated in small niches, attempting to exploit certain competitive advantages within multinational corporations, without any “spillover” to the domestic productive sector. Let’s review the dependence on commodities in figures:

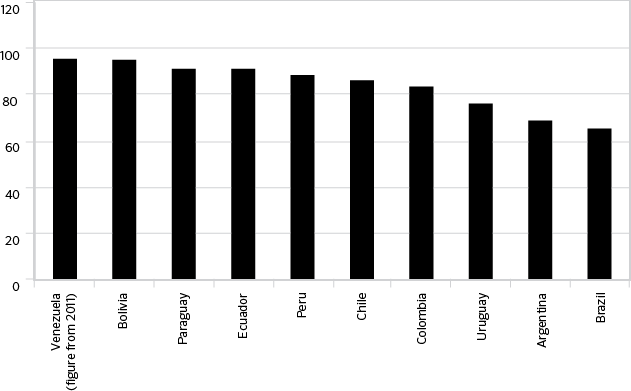

Table 3. Percentage accounted for by raw materials in South American countries’ exports (2013)

To this we must add an important fact. The low proportion of manufacturing exports tended to go to neighboring countries. In other words, the presence of Latin American industry in the global market, outside of regional trade, is almost insignificant. As the UN’s Economic Commission on Latin America and the Caribbean (ECLAC) put it: “the region supplies few industrial goods to global production chains that connect production at various stages to the finished product. North America, Europe and Asia are the world’s three largest manufacturing centers, and, in general, Latin America only provides them with raw materials.”12 The only important exception is México, whose manufactured goods go predominantly to the US. But México’s exceptional situation as the US’s neighbor and haven for maquiladoras makes it hard to conclude that Mexican industrial development is autonomous. The proof of this lies in the other countries that share Mexico’s destination for their manufactured goods: Costa Rica and Honduras. Like México, these have niche manufacturing industries, with foreign-owned maquiladoras primed for export, and with no integration into the domestic economy.

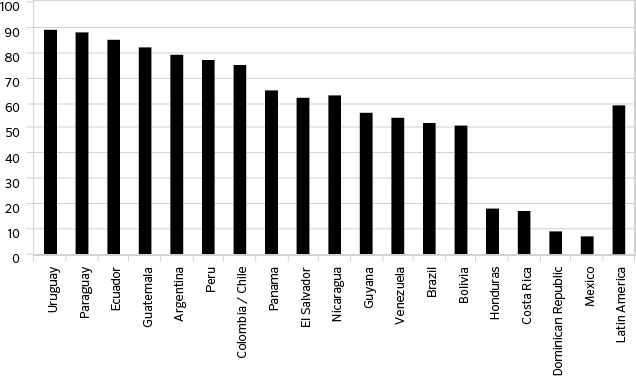

Table 4. Percentage of medium- and high techonology exports to other Latin American countries (2013)

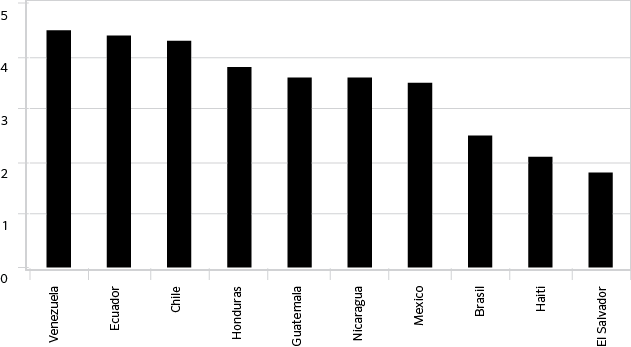

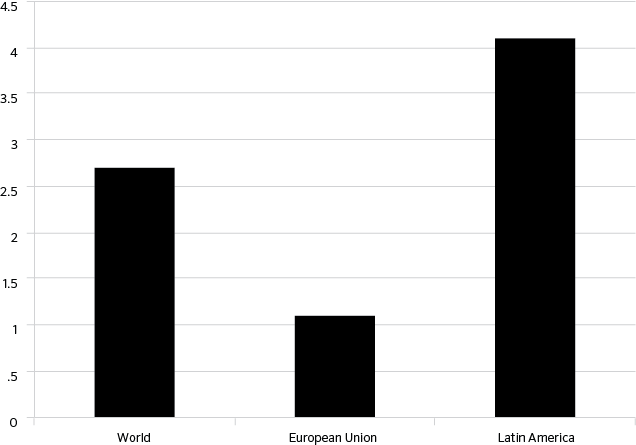

Table 5. Average annual GDP growth, Latin America and the Caribbean, in percent, 2005–2013

Table 6. Average annual world rates of GDP growth, in percent, 2003–2012

Table 7. Average annual rates of GDP growth in Latin America*, in percent, by year

All of these statistics present a snapshot of the Latin American economies after ten years of bonanza in terms of GDP growth, exports, state income, injections of investment, and credit, a reduction in foreign debt exposure, and improvements in income distribution—and before all of these favorable conditions began to go south. Given this, it’s not hard to suppose that what couldn’t be done when conditions were most favorable, will be difficult to do when real problems arise. For the governments that were born in a time of popular rebellion, crisis in the centers of world capitalism, and the relative pullback of the US in the region, their best opportunity has passed. What we can expect of them (at least the ones that survive) isn’t a return to their high points, but to move forward, which will be much harder than before, and whose political payoff will be less immediate. The end of the economic party is here, and with it comes the end of the political party. At a time when the class struggle isn’t challenging the limits of capitalist democracy, this expresses itself in the electoral arena.

That said, it’s necessary to establish certain criteria to define what was lost and what remains from the golden decade, so as to get a handle on the new outlook for the region.

As we’ve noted, the dynamism and stability that the region’s economies had achieved is now in question. Here, the decisive factor is the end of a “recomposition of the terms of trade” that had taken place during the commodities boom driven by Chinese demand. To this, we could add other factors that are reversing trends from the previous cycle. One of these is the abundance of money, from two related sources: low interest rates in the developed world and flows of investment to the emerging economies. These inflows of foreign investment and the ability to finance themselves at low rates momentarily removed a structural defect from Latin American (and all peripheral) economies: “external constraints.” That was the term the 1950s–1960s developmentalists used to describe frequent cutoffs of foreign investment that both caused and illustrated economic dependence on imperialism.

External constraints underpinned the constant “stop and go” cycles in peripheral economies, that followed a predictable trend: growth in industry, employment and exports, producing a trade surplus; but not enough foreign exchange to import the capital goods needed to sustain growth; the end of the trade surplus and growth, followed by a currency devaluation to regain competitiveness in exports, causing the cycle to start all over again. For a while, the “golden decade” masked the structural asymmetries of the imperialist order under a shower of investment dollars, cheap credit, and high-priced exports. But this transitory situation—that some of the region’s “progressive” intellectuals had come to believe was permanent—couldn’t last, and didn’t last.

Chinese industrialization at annual rates of 10 percent or more, and the demand and prices for commodities it produced, couldn’t last indefinitely. Neither could interest rates at near zero throughout the developed world. If the increase in interest rates (encouraged by the end of QE in the US) is slow for now, and its impact has yet to be felt in major ways in the region, sooner or later the impact of higher rates will be felt.

The benefits of lower interest rates were seen in cheap borrowing and an increase in investment. But the latter of these is already declining. After four straight years of growth of foreign direct investment in Latin America, it dropped by 19 percent in 2014, according to the United Nations Conference on Trade and Development (UNCTAD) statistics. An IMF report predicts that, after four years of deceleration, the rate of investment will go negative in 2015.

The result is a decline throughout the region in two key indicators: GDP growth and international trade, both of which have worsened in the last year. Tables 5, 6, 7 and 8 show the difference in GDP growth over the “golden decade” compared to the last year and to the expected performance for this year.

These statistics illustrate the role of the emergent economies throughout this period. In effect, the better part of world growth came from the “developing world,” not from the capitalist center.

We should note that this slowdown in growth isn’t the result of any deep crises in the region. Beyond the obvious inequalities between countries, including those within the region, a slow deceleration took place in Latin America in the 2010s (outside of the Caribbean). It escaped the notice of most analysts, including the region’s governments, which assumed that the previous decade’s strong growth would continue.

|

Table 8. Annual GDP growth, in percent |

||

|

Country |

2014 |

2015 |

|

Brazil |

0.1 |

0.3 (1.0)* |

|

Argentina |

-1.7 |

-1.5 (-0.3)* |

|

Venezuela |

-4.0 |

-7.0 |

|

Colombia |

4.8 |

3.8 |

|

Chile |

1.7 |

2.8 |

|

Peru |

2.5 |

4.0 |

|

Latin America |

1.3 |

1.3 |

|

Emerging economies |

4.4 |

5.0 |

|

World (IMF, 2014 prediction) |

3.3 |

3.8 |

|

World (World Bank, 2015 prediction) |

2.6* |

3.0* |

|

Source: International Monetary Fund; *World Bank, 2015 prediction |

||

|

Table 9. Gross public debt, in billions of dollars |

|||

|

Country |

2008 |

2013 |

Change (in percent) |

|

Brazil |

198 |

309 |

56 |

|

Venezuela |

53 |

119 |

123 |

|

Argentina |

125 |

134* |

7 |

|

Chile |

64 |

131 |

103 |

|

Colombia |

46 |

92 |

98 |

|

Mexico |

129 |

259 |

100 |

|

Latin America |

745 |

1.245 |

66 |

|

Source: ECLAC; *This figure is questionable. The Argentinian government placed the debt at $201 billion in 2013. |

|||

This deceleration has deepened in the last year, with even the most optimistic analysts recognizing it. What is developing now—unlike what happened in the previous period, when Latin America was part of a growing, China-led bloc of emerging countries—is a separation of the emerging economies into distinct trajectories. While the entire group of emerging countries continues to be a major force for world GDP (with the US starting to pull alongside them as a driver of world growth), Latin America is pulling up the rear. Its growth rates are closer to the anemic ones of Europe than of those from the booming periphery of only a few years previously. And these lower, and in some cases recessionary, growth rates are hitting most at the countries that carry the chief economic and political weight in the region.

The same is happening in the area of foreign trade. Latin American exports have stagnated for three years. In 2012, trade increased by 1.6 percent, in 2013, it dropped to .2 percent, and in 2014, in grew only .8 percent, according to ECLAC. This was a far cry from trade during the “golden decade.” Between 2003 and 2013, the average annual growth in trade was 9 percent—even including the last two years of decline.13

In sum, the end of the “virtuous cycle” of rising commodity prices, everexpanding Chinese demand, cheap credit and strong investment from abroad, is perceptibly changing the region’s economic profile. This is reflected in the decline in economic growth and the sustainability of a political economy based on income redistribution within existing economic structures.

One of the problems that was even said to mark the region’s decisive advance—the taming (but not elimination) of the foreign debt, has to be put in perspective. Despite the claims from many of the “progressive” governments, there hasn’t been a decline in the debt. In fact, as Table 9 shows, the mass of debt increased by two-thirds in only five years. And with the decline in commodity prices and the drop in exports, debt service will start to become a top concern for Latin America’s macro economy. Access to credit and international investment flows will affect this process.

It’s hard to call a two-thirds increase in the mass of debt in only five years “deleveraging.” Certain factors that temporarily lightened the weight of debt service came together: a) in some cases, most notably in Argentina, a portion of the debt was redenominated in cheaper local currencies; b) debts were renegotiated to be paid over longer terms; c) the increase in revenues from exports allowed a general improvement in the quality of foreign reserves held, with notable exceptions of Venezuela and Argentina; d) increases in GDP and exports altered the debt-to-GDP ratio, making sovereign debt more manageable (or at least more sustainable, when compared to the debt of several Eurozone countries, as Latin America’s “progressive” presidents are fond of pointing out).

However, having temporarily loosened the “debt tourniquet” for several years doesn’t mean that Latin America has escaped its consequences. It still has the potential to discipline governments and to reinforce their dependency on the core countries. Given the decline in commodity prices and income from exports, it’s likely that problems with the debt will move to the top of the Latin American macro-economic agenda. The same can happen with access to credit and the investment flows.

To these new instabilities we must add another factor: Latin American currencies have weakened against the dollar, after years of appreciation. Changes in exchange rates are no more than the monetary expression of changing global economic conditions. In contrast to the “stop and go” policies we mentioned earlier, today’s devaluations are a) forced, not voluntary; b) gradual, rather than products of a “shock”; and c) aren’t aimed in the first instance at changing the mix of exports and imports in service of “external constraints.” According to ECLAC, the region’s imports fell by .6 percent in 2014, compared to an increase of 3 percent in the two years before. It doesn’t seem like much, but it looks like the beginning of a trend. The result is a slowdown in growth or a lapse into recession, which puts a squeeze on imports. Venezuela and Argentina are the most flagrant examples of this process, where a shortage of foreign exchange restricts imports, stalls economic activity, and puts pressure on the governments to change course.

Nevertheless, and in contrast to previous economic cycles, the emerging economies, including those in Latin America, are better able to adjust to this change in the economic cycle. We’ve already pointed to the larger volume of currency reserves, the lower exposure of debt to foreign currency fluctuations, and a lowering of the debt in relation to GDP. At the same time, core countries’ central banks have less leeway to raise interest rates to levels that have historically hurt Latin America. Even if the “golden decade” bonanza is gone, we have to be cautious about forecasts of catastrophe across Latin America as a whole. It makes more sense to pay close attention to the region’s “weak links” (especially Venezuela), whose eventual shift could signify a profound change. This wouldn’t stem from an economic crisis per se, but from a change in the constellation of political forces. Depending on whether politics shifts left or right in Venezuela, a new correlation of forces may emerge.

Part of this new correlation of forces is the appearance of the new player in Latin America, and the “last resort” for more countries in the region. This player, whose role in Latin America is entirely new, has acquired major importance. Of course, we are referring to China, which is part of a new geopolitical balance in a setting where only the US had played the economic, political, and military role of “Big Brother”. In part two we will try to elucidate some of the areas where China’s intervention has affected Latin America.

- The original is available at http://www.socialismo-o-barbarie.org/?p=....

- “The Headwinds Return,” The Economist, September 13, 2014, at http://www.economist.com/news/briefing/2....

- “The Great Deceleration”, The Economist, November 22, 2014.

- “The Headwinds Return.”

- Ironically, in 1997, just before the emerging economies began their advance in relation to the core economies, Lane Pritchett, the World Bank’s chief economist, described the growing gap in incomes between the rich and poor countries as the “dominant characteristic of modern economic history,” in contrast to models of economic growth, like that of Robert Solow (1956), that predicted the opposite.

- “The Headwinds Return.”

- It’s important to emphasize this point, because while some of the supporters of the “populist” governments are overly celebrating the “end of external constraints,” some voices on the crude Left deny this as a matter of principle, as if the bonanza years hadn’t happened. The reality, in our opinion, is more mixed. While it didn’t move by even a millimeter the structural underpinnings of the region’s dependency in relation to imperialism, nor changed its subordinate role in the world division of labor, the “golden decade” didn’t just leave Latin America with the same level of vulnerability to external crisis as it had in the 1990s, for example.

- QE is the program of central bank buying of sovereign debt, of more than $60 billion in euros monthly, until September, 2016, although the date is subject to change, based on the rate of inflation. It would result in the purchase of more than a trillion euros of debt. To compare, the third and final stage of the US Federal Reserve’s QE policy involved $85 billion a month, until it tapered down at the end of the program. Draghi’s aim is to boost inflation to about 2 percent from 0-1 percent today (with some countries recording some months of negative real inflation rates).

- This economic performance influenced the perspective of greater liberalization, including a law to encourage foreign investment. James Zhan, director of UNCTAD, noted that the service sector and high tech led China’s jobs growth, with a decline in manufacturing, in early 2015. On the other hand, China’s lead on the US is even greater considering that Hong Kong, with $110 billion in foreign investment, is treated as a separate entity. Although Hong Kong is treated separately in statistics, there is little doubt that investment is tied to the Asian giant, and not the former British colony.

- In relation to this, we noted a presentation at the 2014 Jornadas de Economía Crítica in La Plata, Argentina by the Uruguayan economist Eduardo Gudynas — who is not sympathetic to Trotskyism or similar politics— which demonstrated with devastating facts and figures how, from Evo Morales to Correa to the Kirchners, these governments have pushed economic policies that are aimed less at structural change than at electoral popularity. That is to say, they’ve emphasized income redistribution. These policies have been pursued to the detriment of the old ECLAC-promoted economic planning, which put a priority on improvement in structural factors of income redistribution (access to safe water, housing, transportation). All of this was relegated to a consumerist logic tied to the consumption of semi-durables (which Gudynas calls ‘a compensatory state’). It recalled the Bolivarian general Hebert García Plaza’s memorable TV address: “We have to guarantee that all Venezuelans have a plasma TV and the latest model refrigerator!” So we must guarantee increased access to consumer goods, not improvement in living standards besides income, which would require more time, resources and state planning, without immediate electoral payoff!

- George Gray Molina, “Inequality is Stagnating in Latin America,” The Guardian, August 27, 2014.

- Quoted in El País, Madrid, October 10, 2014.

- See www.ecuador.org.

Facebook

Facebook Twitter

Twitter Google+

Google+ Tumblr

Tumblr Digg

Digg Reddit

Reddit StumbleUpon

StumbleUpon